“Technically Speaking” is a regular Tuesday commentary updating current market trends and highlighting shorter-term investment strategies, risks, and potential opportunities. Please send any comments or questions directly to me or via Twitter.

With Thanksgiving week rapidly approaching, I thought it was an apropos time to discuss what I am now calling a “Turkey” market.

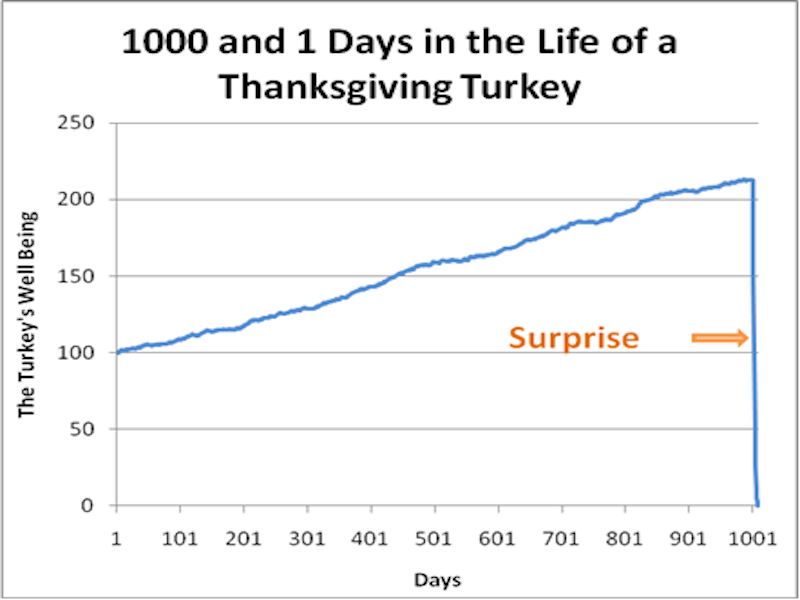

What’s a “Turkey” market?Nassim Taleb summed it up well in his 2007 book “The Black Swan.”

“Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race ‘looking out for its best interests,’ as a politician would say.

On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief.”

Such is the market we live in currently.

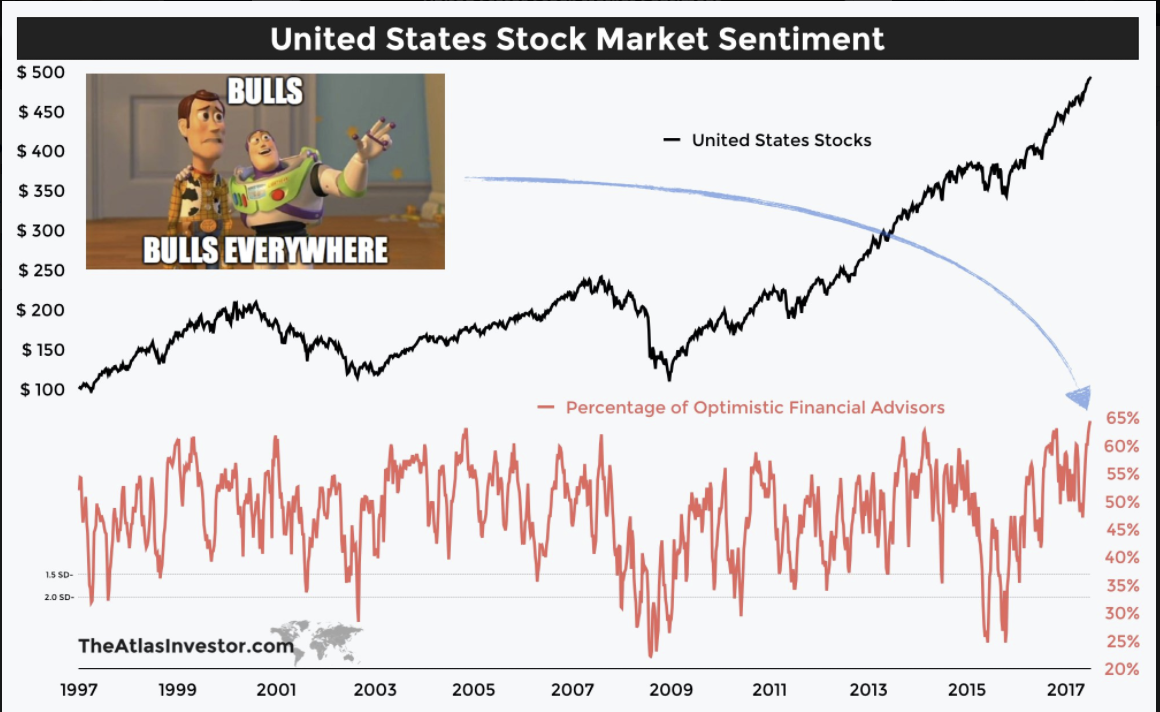

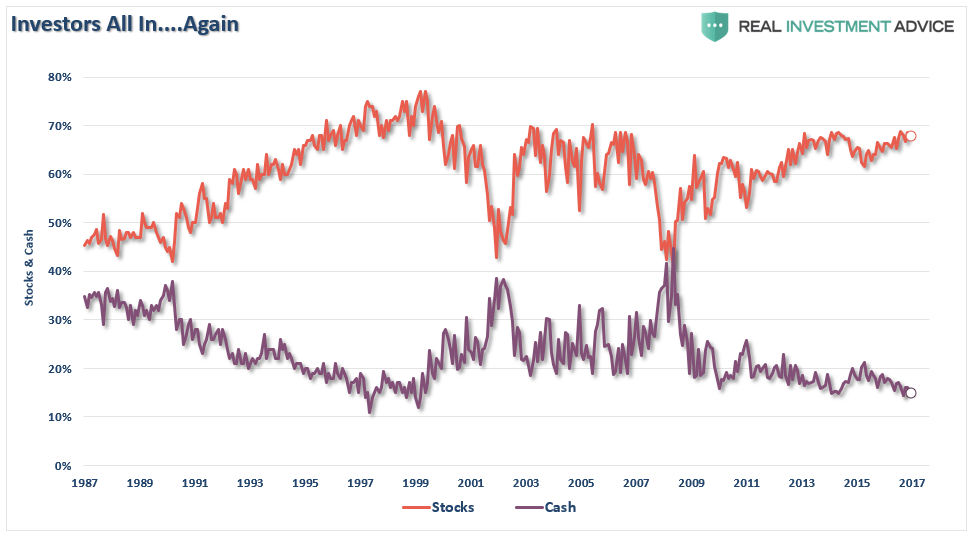

In a market that is excessively bullish and overly complacent, investors are “willfully blind” to the relevant “risks” of excessive equity exposure. The level of bullishness, by many measures, is extremely optimistic, as this chart from Tiho Krkan (@Tihobrkan) shows.

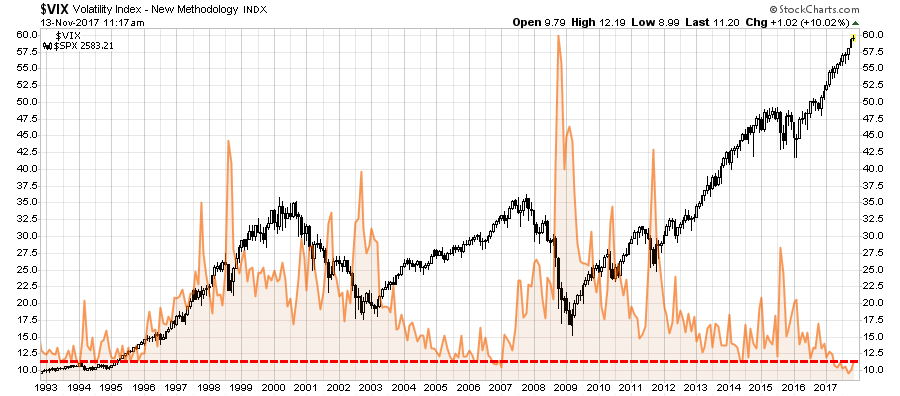

Not surprisingly, that extreme level of bullishness has led to some of the lowest levels of volatility and cash allocations in market history.

Of course, you can’t have a “Turkey” market unless you are being lulled into it with a supporting story that fits the overall narrative. The story of “it’s an earnings-driven market” is one such narrative. As notedby my friend Doug Kass:

“Earnings are there to support the market. If we didn’t have earnings to support the market, that would be worrying. But we have earnings.”

—Mary Ann Bartels, Merrill Lynch Wealth Management

“Earnings are doing remarkably well.”

—Ed Yardeni, Yardeni Research

“This is very much an earnings-driven market.”

—Paul Springmeyer, U.S. Bancorp Private Wealth Management

“This is very much earnings-driven.”

—Michael Shaoul, Marketfield Asset Management

“Equities have largely been driven by global liquidity, but they are now being driven by earnings.”

—Kevin Boscher, Brooks Macdonald International

“Most of the market action in 2017 has been earning-driven.”

—Dan Chung, Alger Management

“The action is justified because of earnings.“

—James Liu, Clearnomics

In another case of “Group Stink” and contrary to the pablum we hear from many of the business media’s talking heads, the U.S. stock market has not been an earnings-driven story in 2017. (I have included seven “earnings-driven” quotes above from recent interviews on CNBC, but there are literally hundreds of these interviews, all saying the same thing)

Rather, it has been a valuation-driven story, just as it was in 2016 when S&P 500 profits were up 5% and the S&P Index rose by about 11%. And going back even further, since 2012 S&P earnings have risen by 30% compared to an 80% rise in the price of the S&P lndex!

Leave A Comment