I love trolls.

One of my favorite things to do is read the comments from readers. Most of the comments are generally insightful, well-intentioned, contribute to the community and inspire thought particularly when they disagree with my own views.

Then, there are the “trolls.”

“Trolls” are anonymous posters who have nothing better to do with their lives than try to degrade the dialog, and the intellectual commentary and community, by posting diatribe which shows their own lack of intellect, experience and, human decency.

Generally, I don’t waste my time responding to them but a comment to last weekend’s newsletter showed a clear lack of understanding about portfolio management and the investing process as whole. (Notice the anonymous handle)

“5731311 – Every week I want to write an article crying wolf calling for a market crash, but actually stay fully invested. Then I will also offer 3 mutually exclusive scenarios for the near term. Then next week, I will say – see, I told you so, I was right on one of my predictions. I’m a genius.”

First, I have the “cojones” to analyze, write and publish on a very regular basis. “Trolls” hide behind anonymity as they don’t have the backbone to publish their own views and open themselves up for public scrutiny.

Secondly, if you actually read my articles you will already know that I have not been calling “for”a market crash, but rather pointing out that one is inevitable since such is part of the “boom/bust” cycle of the markets.

Lastly, yes, I absolutely offered 3-potential outcomes for the near term in this past weekend’s missive, to wit:

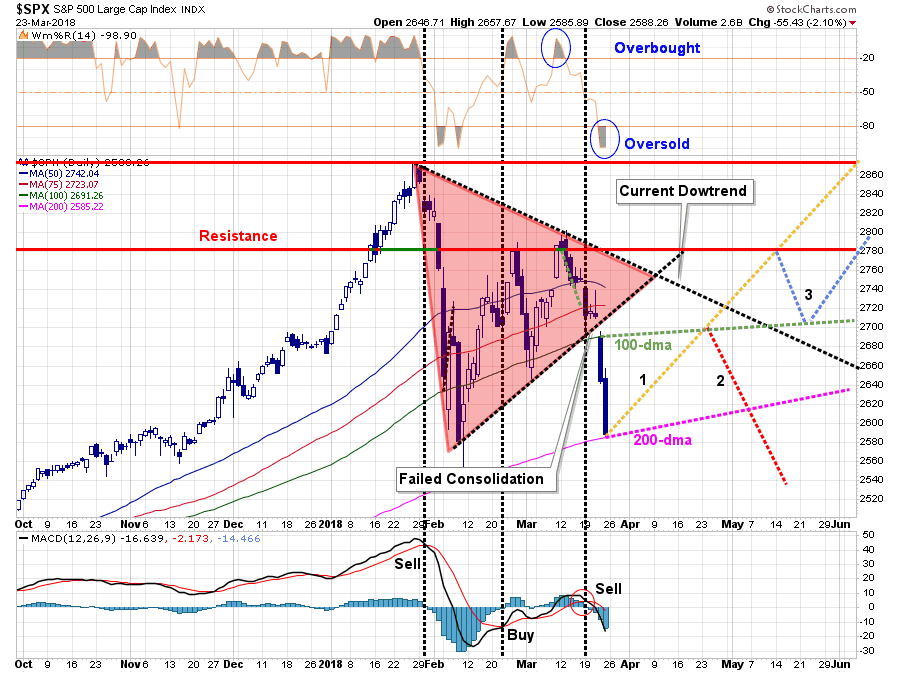

“Considering all those factors, I begin to layout the “possible” paths the market could take from here. I quickly ran into the problem of there being “too many” potential paths the market could take to make a legible chart for discussion purposes. However, the bulk of the paths took some form of the three I have listed below.”

- Option 1: The market regains its bullish underpinnings, the correction concludes and the next leg of the current bull market cycle continues. It will not be a straight line higher of course, but the overall trajectory will be a pattern of rising bottoms as upper resistance levels are met and breached. (20%)

- Option 2: The market, given the current oversold condition, provides for a reflexive bounce to the 100-dma and fails. This is where the majority of the possible paths open up. (50%)

- The market fails at the 100-dma and then resumes the current path of decline violating the current bullish trend and officially starting the next bear market cycle. (40%)

- The market fails at the 100-dma but maintains support at the 200-dma and begins to build a base of support to move higher. (Option 1 or 3) (20%)

- The market fails at the 100-dma, finds support at the 200-dma, makes another rally attempt higher and then fails again resuming the current bearish path lower. (40%)

- Option 3: The market struggles higher to the previous “double top” set in February, retraces back to the 100-dma and then moves higher. (30%)

Leave A Comment