Just a short note for today as I am taking a quick vacation for the “Thanksgiving” holiday.

As I noted this past weekend:

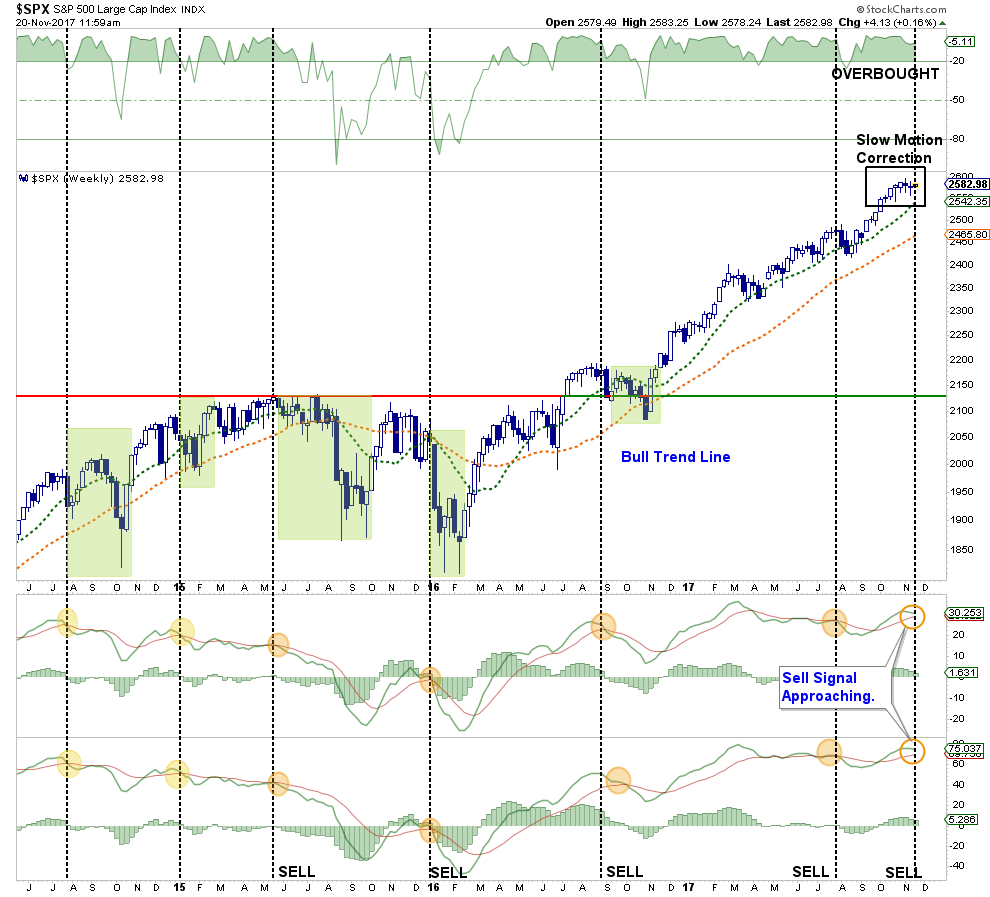

“Thanksgiving week is traditionally an extremely ‘light’ trading period where the ‘inmates are running the asylum.’ With the market more overbought now than at any other period since 2011, a consolidation or further corrective action is entirely possible.

While some ‘caution’ is advised, it is NOT advisable to act ’emotionally’ to swings due to the low volume trading that will be occurring.

While the market is extremely overbought, the bullish trends remain intact. Furthermore, the last two months of the year are typically bullish for asset prices. Understanding this, these conditions keep portfolios allocated towards equity risk currently. But we do so with an eye on the risk.”

As shown below, the market is clearly overbought as the “slow motion” correction over the last 3-weeks has begun to deteriorate the September “buy” signal. While corrections have been extremely shallow (less than 3%), a continued stagnation or deterioration over the next week will likely trigger a short-term “sell signal.” This would set the stage for a mild correction in the second week of December as liquidations by mutual funds to pay out annual distributions occurs. Such a correction would work off some of the existing overbought condition and set the stage for a year-end “Santa Claus” rally.

The bigger concern, as stated over the last two weeks, is when the calendar turns into 2018. There is a risk of a deeper correction as tax-selling, concerns over monetary policy and geopolitical stresses potentially take hold. However, that is a story we will deal with over the next couple of weeks as the markets continue to develop.

For now, I am going to return to my seat, put my tray table up and settle back for my flight. I think I hear the sound of the stirring of a margarita glass and I am seriously stuck on the “salted vs non-salted” rim question.

Leave A Comment