Is the worst behind us? Maybe. Yet the appetite for risk is decidedly less vibrant than before the August-September meltdown. (Review Market Top? 15 Warning Signs.)

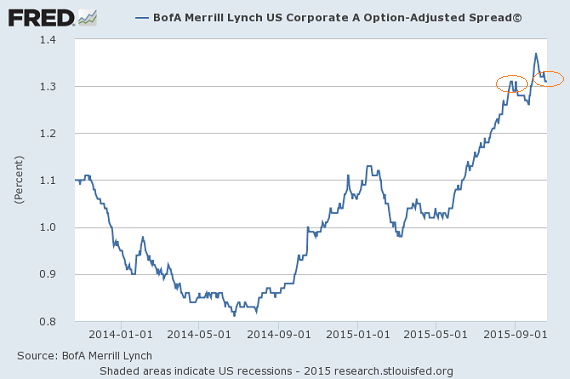

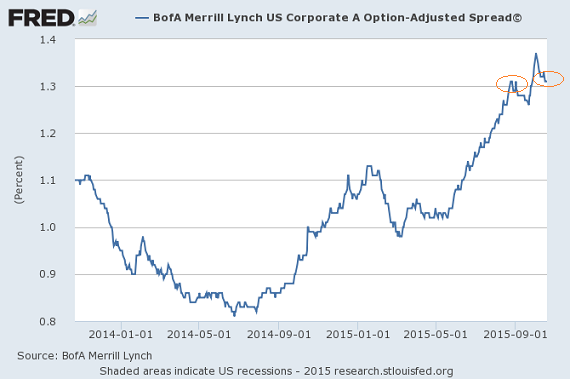

Consider high-quality bonds as represented by the Bank of America Merrill Lynch US Corporate A Option-Adjusted Spread. The yield spread between A-rated companies and comparable U.S. treasuries typically falls during periods when investors are feeling confident. This was the case throughout 2014. In contrast, when investors are concerned about their exposure to corporate credit, the spread widens. Indeed, the difference between A-rate corporate bonds and U.S. treasuries steadily rose in the summertime.

The Bank of America Merrill Lynch US Corporate A Option-Adjusted Spread spiked above 1.3 during the stock market lows in August and again at the start of October. It has since come down below a high-water mark in 2015, though it remains stubbornly high. Granted, there is nothing magical about this particular yield spread at 1.3 percent. On the other hand, a similar pattern of risk aversion occurred during the summer of 2007, right before the stock market’s bearish collapse (10/07-3/09).

Some equity advocates prefer to dismiss warning signs of risk-off behavior in bonds. They have been assigning blame for lack of interest in high-yield “junk” to the ailing energy sector. However, funds like iShares iBoxx High Yield Corporate Bond (HYG) and SPDR High Yield Corporate Bond (JNK) do not hold single A-rated bonds like Kimberly Clark (KMB) and Target (TGT).

“Single As” are highly rated because the risk of default is negligible and they are as reliable as rain in Seattle. What’s more, they usually exhibit narrow spreads with comparable treasuries. It follows that a substantial “risk-on” return to stocks from current levels is unlikely to occur without a meaningful retreat below 1.3% in the Bank of America Merrill Lynch US Corporate A Option-Adjusted Spread.

Leave A Comment