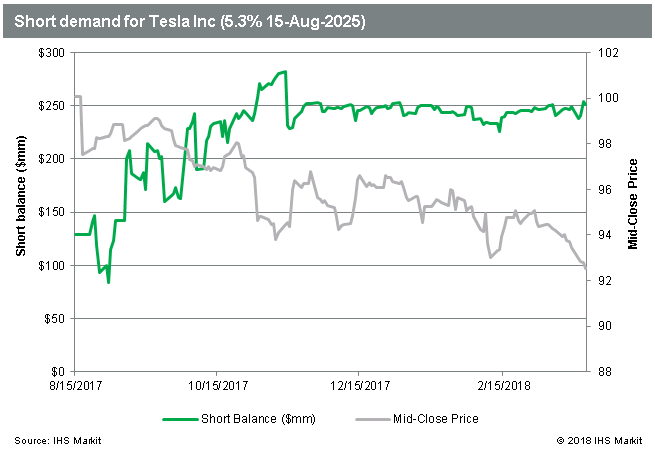

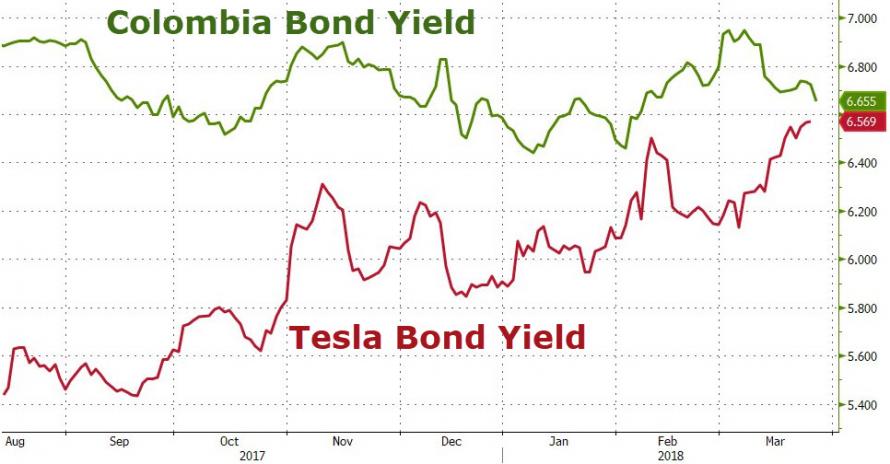

While Tesla shares have slipped but remain above Nov ’17 lows, Tesla’s bond yields have surged to a new record high (the same a Colombia) and bond short-sellers are adding as the price plunges.

99% of lendable supply for shorting Tesla’s high-yield bond has been used, sending the cost for new short positions in the bond to their highest ever, Sam Pierson, director, securities finance, at IHS Markit said in a Monday note.

Bets against that bond account for the bulk of the total short demand of $261 million for Tesla debt, according to IHS Markit.

Traders bet against a stock by borrowing and then selling shares in expectations they can buy them back cheaper later, or cover their shorts. It works the same for bonds basically.

However, as Pierson notes, as bond prices have plunged, yields surged, short-sellers have not covered at all…

“While equity short sellers continue to hang around, shorts in the most liquid TSLA bond have made a tidy profit so far in 2018…

They have not covered to lock in the profit, suggesting that they think the credit will continue to deteriorate.”

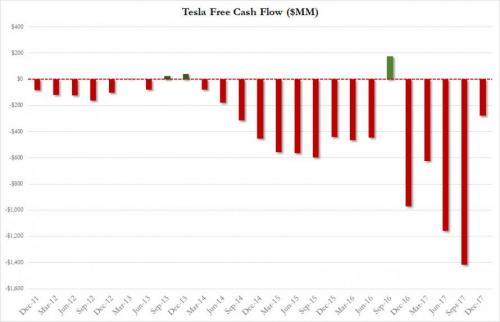

Signaling expectations of further pain to come from the cash-burning company…

All of which has pushed Tesla’s bond yield above those of Romania, Peru, Chile, and Philippines, and in line with Colombia…

As CNBC reports, short interest in Tesla shares has also increased to 17.9 percent, Pierson said. The total dollar amount of nearly $8.7 billion is second only to the $9.7 billion short balance in shares of Apple, the largest U.S. stock, according to exchange data as of the end of February cited by Pierson.

“Tesla shares may be nearing a cross-road,” Pierson said.

“With the short demand for Tesla increasing through the recent sell-off – and the short demand for bonds fully utilizing the available supply – it appears short sellers are looking for more downside before they begin to cover.”

Leave A Comment