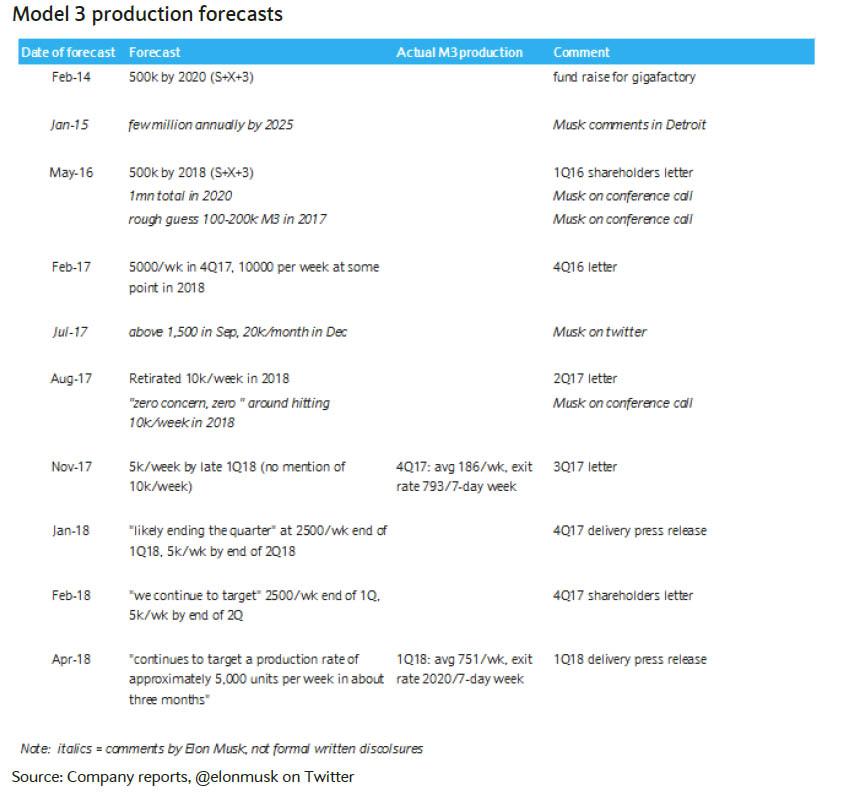

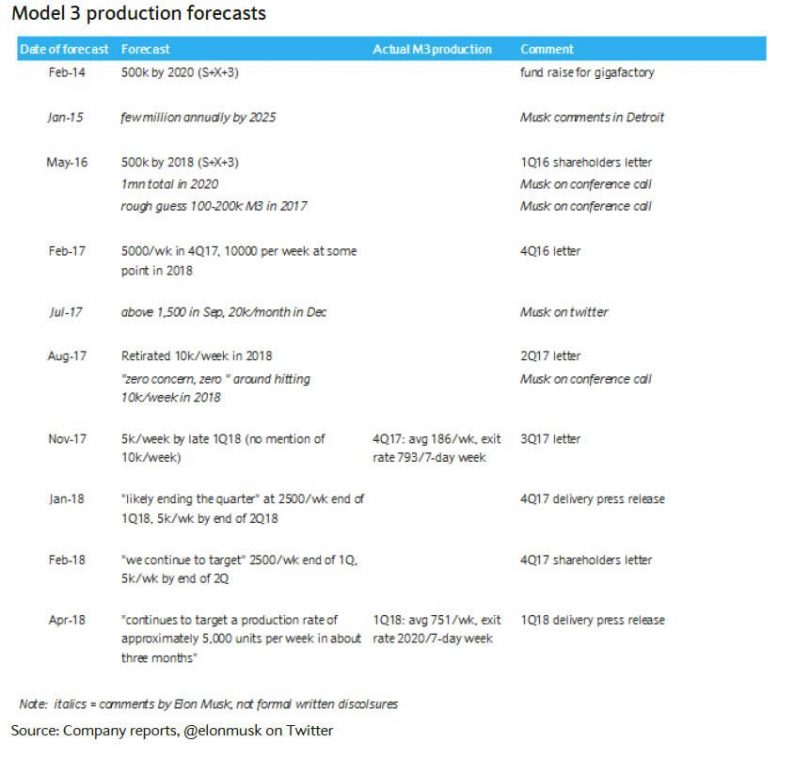

Amid reports of a slowing ramp up in Model 3 production, and Elon Musk’s own repeated warning last quarter that manufacturing challenges during a production ramp such as this “makes it difficult to predict exactly how long it will take for all bottlenecks to be cleared or when new ones will appear”…

… in addition to numerous other debacles, including Musk joke-tweeting about bankruptcy, or admitting he made a mistake in betting on “excessive automation'”, not to mention the departure of Tesla’s Autopilot chief last month, following a fatal crash in California in March, investors were looking ahead with borderline terror to today’s Tesla Q1 earnings report, especially with Elon Musk’s attention recently seemingly more focused on outer space than dominating the terrestrial auto sector not to mention his increasingly more erratic tweets, despite the stock rising in recent days on hopes that the company will finally be able to hit its new, reduced target of 5,000 cars per week as it is now reportedly making 2,000 Model 3s per week.

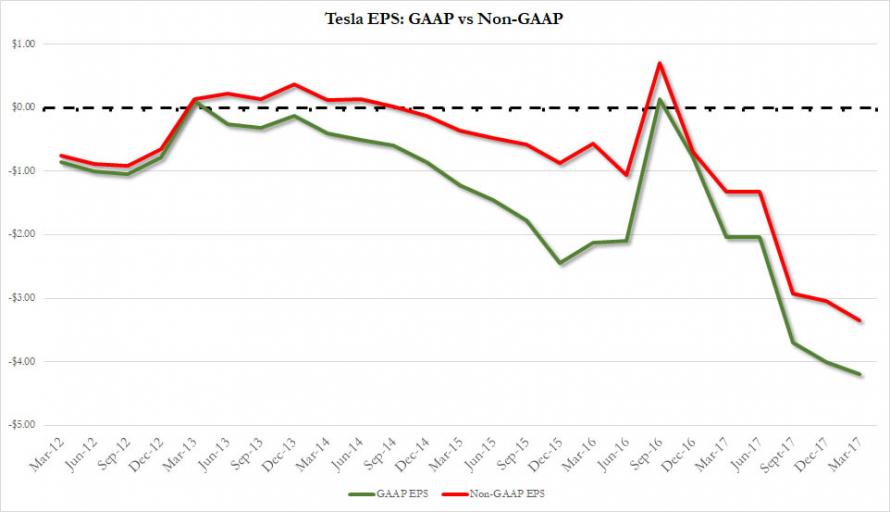

Well, this time around, there was no immediate bad news, when Tesla reported a Q1 loss of $785 million, or an adjusted EPS of ($3.35) (and $4.19 on a GAAP basis), better than the $3.41 expected, if nearly 3 times more than the $1.33 loss one year ago.

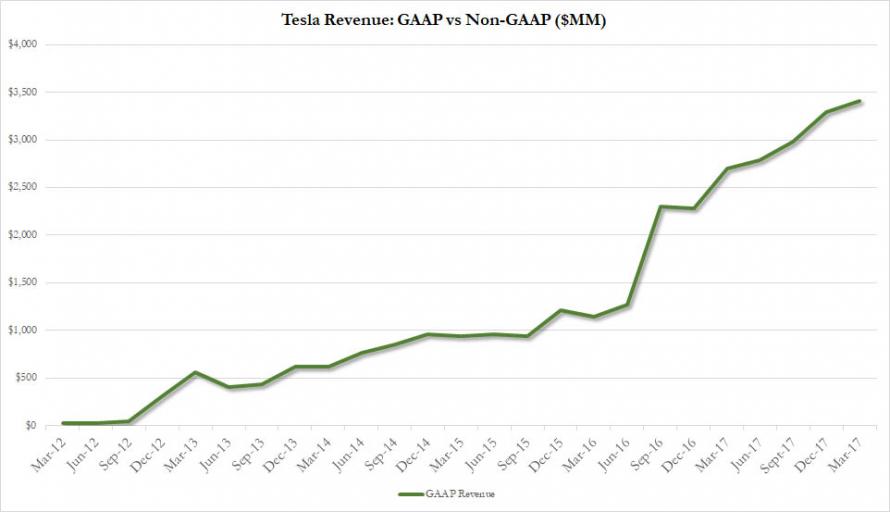

There was more good news hiding in Tesla’s top line: the company reported revenue of $3.41bn, also magically just above the $3.32 billion expected, which was further boosted by an increase in the gross margin which rose from 13.8% to 18.8%,well above the 14.3% estimate (although on a GAAP basis, gross profit was naturally far lower, or 13.4%). Meanwhile, automotive gross margins fell from a quarter a year ago to 19.7% from 27.4%

Echoing what Elon Musk said on the Q4 call, Tesla said it will reach full GAAP profitability in Q3 and Q4. That said, there was a major caveat, with Tesla warning that it would do so only if it “execute according to our plans.” What are the plans?

This is primarily based on our ability to reach Model 3 production volume of 5,000 units per week and to grow Model 3 gross margin from slightly negative in Q1 2018 to close to breakeven in Q2 and then to highly positive in Q3 and Q4.

Well, good luck with those 5,000 units per week.

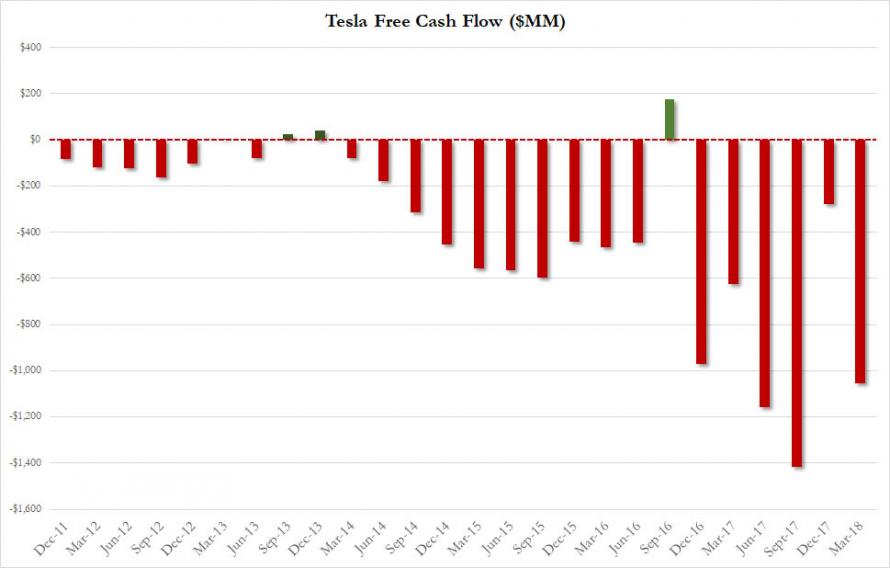

But once again the biggest (non) surprise was in Tesla’s cash burn which after plunging from a record $1.4 billion in Q3 to just $276.8 million in Q4, far below the $900 million expected, is baaaack, and soared to $1.05 billion in Q1, or roughly $12 million per day. This means that Musk’s plan of being cash flow positive by the second half is pretty much scrapped.

Leave A Comment