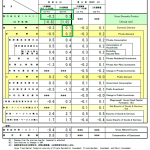

Tesla Motors, Inc. (TSLA – Analyst Report) reported adjusted loss (excluding one-time items other than stock-based compensation expense) of $1.01 per share in the third quarter of 2015, much wider than adjusted loss of 29 cents recorded in the year-ago quarter. Moreover, the loss was significantly wider than the Zacks Consensus Estimate of a loss of 71 cents per share.

Tesla Motors Inc. (TSLA – Analyst Report) – Earnings Surprise | FindTheCompany

The company’s third-quarter 2015 adjusted results exclude the impact of non-cash interest expenses related to convertible notes and other borrowings of 17 cents per share, and deferred gross profit of 60 cents for Tesla’s Model S cars due to lease accounting. On the other hand, Tesla’s third-quarter 2014 adjusted results excluded the impact of non-cash interest expenses related to convertible notes and other borrowings of 15 cents per share, and deferred gross profit of 12 cents for its Model S cars due to lease accounting. Including these items, the company reported a net loss of $1.78 per share in the third quarter of 2015, compared with a net loss of 52 cents per share in the third quarter of 2014.

Adjusted revenues improved 33% to $1.24 billion in the reported quarter and steered past the Zacks Consensus Estimate of $1.21 billion. On a reported basis, revenues increased 10% to $937 million.

Tesla delivered 11,603 cars in the reported quarter, higher than the expectation of 11,532 deliveries. The company also has a higher number of vehicles in transit to support fourth-quarter deliveries. Meanwhile, Tesla manufactured 13,091 vehicles in the quarter, exceeding the projected production of 12,000 vehicles.

In the third quarter of 2015, the electric automaker directly leased 494 cars worth $45 million of aggregate transaction value. The company’s lease partners had a higher percentage of leased vehicles, thus reducing the percentage of vehicles directly leased by Tesla.

Leave A Comment