Everyone already knows that Tesla (TSLA: $345/share) loses a great deal of money and has massive growth expectations baked into its stock price. Despite these obvious concerns, the stock has continued to soar on the hope that the company’s technological advantage will allow it to dominate the growing electronic vehicle (EV) market and play a big role in energy storage.

2018 could be the year the market starts to see through this bullish thesis. In reality, Tesla’s technological advantage is slim or even nonexistent, and it’s facing a growing stable of competitors with more resources and more expertise. As competitors begin eating into its market share, Tesla won’t be able to keep distracting from its current problems by promising the next big thing. This increased competition, combined with a sky-high valuation, lands Tesla in the Danger Zone.

Tesla’s Tech Doesn’t Live up to the Hype: Autopilot Tech Ranks Last

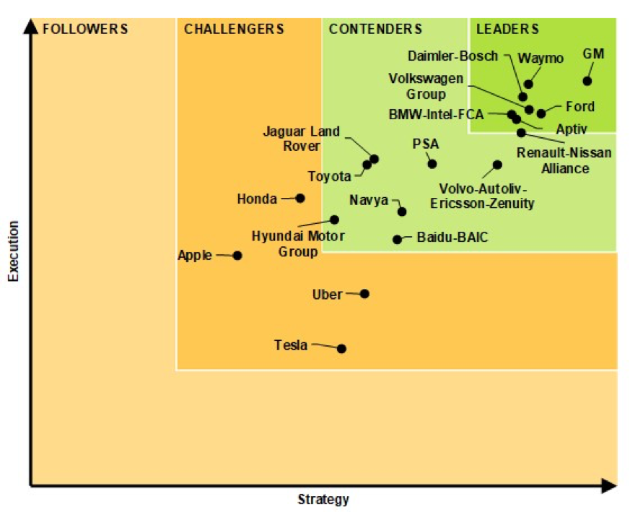

Tesla’s autopilot feature has been a big selling point of its existing car models, and the company recently announced that it’s producing AI chips that Elon Musk claims “will be the best in the world.” So naturally, when Navigant research analyzed the top 19 companies developing self-driving technology, Tesla ranked… dead last.

Figure 1: Tesla Ranks 19th out of 19 in Self-Driving Technology

Sources: dead last

Navigant sees Tesla as a distant challenger in the self-driving space, while the leaders are established car companies such as GM (GM) and Ford (F) along with Alphabet’s Waymo (GOOGL). While Tesla hypes up its self-driving cars that don’t deserve the name, GM is preparing to deploy fully autonomous vehicles next year.

Tesla’s Tech Doesn’t Live up to the Hype: Battery Tech Shows No Signs of Further Gains

On the battery front, Tesla continues to make claims it can’t back up. Some of its promises, like a semi-truck that can haul 80,000 pounds for 500 miles, may be feasible if battery technology continues to advance at the same rate. Other claims, like charging stations that will give those trucks 400 miles of charge in 30 minutes, appear completely impossible. To achieve the latter goal, Tesla’s charging stations would need a tenfold leap in efficiency.

Nevertheless, promises like these would lead one to believe that Tesla has made some significant breakthrough in battery technology, but we cannot find evidence to support that assertion. While the company may have a marginal advantage due to refinements to the production process and the scale of the Gigafactory (if they ever get production running smoothly), experts project the competition to catch up very soon.

Tesla’s scale advantage should melt away fairly quickly. Chinese companies are targeting battery factories that would out produce the Gigafactory more than 3 to 1 by 2021. Two former Tesla executives are building their own battery factory with the backing of VW. Without some unforeseen technological breakthrough, it’s hard to see how Tesla can have any long-term competitive advantage around battery production.

Leave A Comment