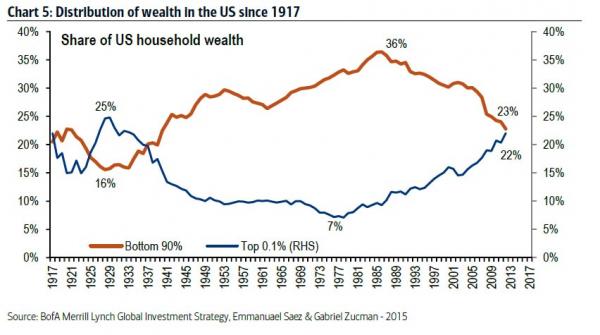

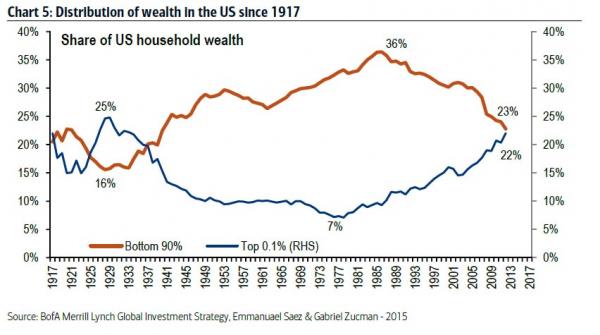

On of the key things to understand about the massive, coordinated, global easing effort on which central banks have embarked since the financial crisis is that these policies have served to widen the gap between the rich and poor.

Ben Bernanke – and plenty of other vaunted central planners for that matter – will tell you a different story. They’ll tell you that by creating jobs and boosting the economy, QE and ZIRP have actually done more for the middle- and lower-classes than they have for the wealthy.

Obviously, that’s nonsense. When you adopt a set of policy measures specifically designed to inflate the value of the assets that are most likely to be concentrated in the hands of the rich, you perpetuate inequality and exacerbate class segregation by default – indeed, by definition. Here’s proof:

If it wasn’t for Ben “the Hero” Bernanke’s courage to print like a drunken Keynesian madman, none of this would have been possible, and by “this” we of course mean that the net worth of the top 0.1% of Americans is about to surpass the wealth of the bottom 90% of US households.

This is everywhere apparent and has been documented by the Fed itself on at least one occasion this year. Meanwhile, asset bubbles in things like high end art and mega mansions underscore the extent to which the top echelons of society are increasingly flush.

Credit Suisse is now out with the latest edition of its Global Wealth report and although the results are not surprising, they are worth highlighting.

Three standouts: i) the rise in the value of financial assets is most certainly contributing to an increase in global inequality, ii) dollar strength led to the first decline in total global wealth (which fell by $12.4 trillion to $250.1 trillion) since 2007-2008, iii) 0.7% of the world’s population own nearly half of the world’s wealth while the bottom 71% of the population own just 3%.

Leave A Comment