Dividend growth investing is one of the best ways to build wealth over the long-term.

But sometimes, stocks go down.

This is the trade-off to investing in the stock market. An investor needs to resist the urge to sell, even during market downturn.

To be fair, this is no easy task. It is very difficult to stay with stocks when we see our brokerage statements painted with red ink.

That said, those who have the steely resolve to stay in the market can reap huge rewards.

The following three stocks are all Dividend Achievers, a group of 271 stocks with 10+ years of consecutive dividend increases.

And, the three stocks mentioned below are among the worst-performing Dividend Achievers year-to-date.

This article will discuss why their declining share prices could represent an attractive buying opportunity.

Target (TGT)

YTD Performance: Down 24%

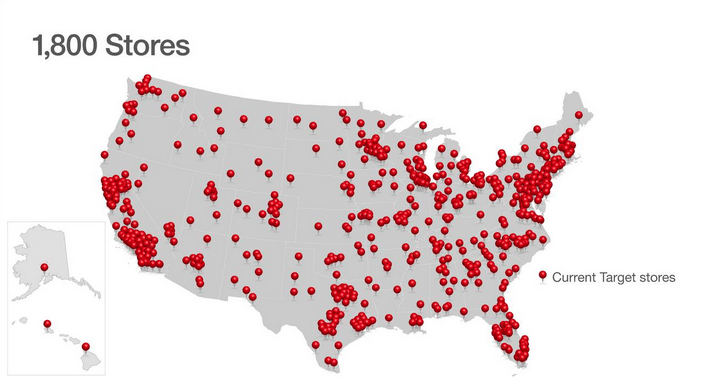

Target is a discount-retail giant, with 1,800 stores throughout the U.S.

Source: 4Q Earnings Presentation, page 74

Not only is Target a Dividend Achiever, it is a member of the Dividend Aristocrats as well.

Dividend Aristocrats are a group of 51 companies in the S&P 500, with 25+ years of consecutive dividend increases.

Target has fallen on hard times in 2017, because of the company’s announcement that it will compete more aggressively on price, ramp up its e-commerce platform, and invest more in its stores going forward.

This will have an adverse impact on Target’s bottom line—the company expects adjusted earnings-per-share to decline 20%, at the midpoint of its fiscal 2017 forecast.

While investors are rushing for the exits, long-term investors should view the announcement as a positive.

Competing on price and bolstering its online presence will be critical for Target to keep up, in the new age of retail.

Internet-based retailers like Amazon.com (AMZN) are a huge threat to brick-and-mortar retailers like Target. As a result, Target is doing what needs to be done, in order to compete.

Leave A Comment