About two weeks ago, I wrote an article about volatility. I was basically explaining that market timing was futile and investing in a high or in a low in the market has a very limited impact. This article was republished on SA. There were several investors over there who were happy to jump on the article to tell me that we were on a verge of a market collapse and that the stupidest move would be to invest at the moment. Their thesis is quite simple (man I should be damned to be so stupid!):

The FED has created the current bullish market since 2009 with quantitative easings;

Chinese market dropped by 50% last year;

The economy is going nowhere;

We are walking on thin clouds and we we will soon wake up;

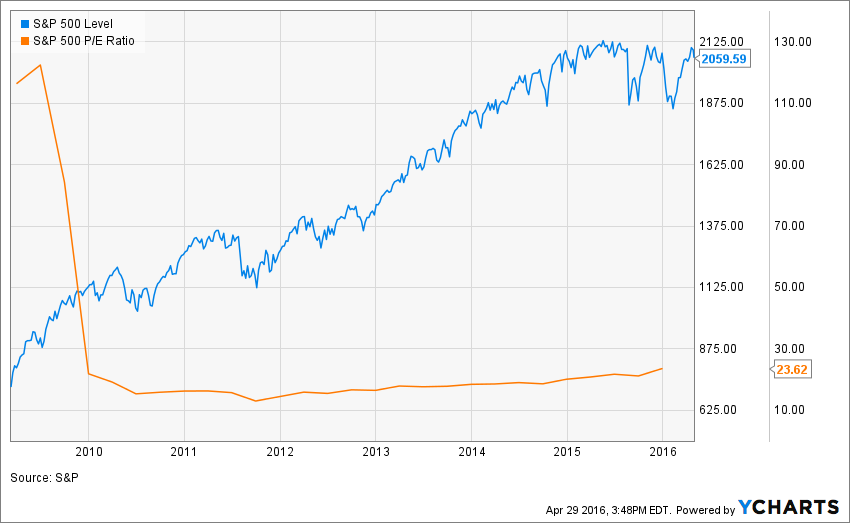

The market is trading at an all time high…

Source: Ycharts

All right… I get the point, if it’s high, it should go down… logically.

I can’t argue the current PE ratio is not low either:

Source: Ycharts

Based on these two graphs, it doesn’t make sense to invest new money in the stock market today right?

So Let’s SELL NOW… oh wait…

I’ll try to apply the same rationale with the following graph with no dates:

Source: Ycharts

The stock market is clearly up (+74%) and we can see it hits a resistance. On top of that, I can tell you there is very bad news at that time:

Somes countries will go bankrupt in a manner of months;

The banking system is doomed, it’s just not announced yet;

The FED is printing money and they lost control of their machine… it’s going to blow up in their faces!

Yes… we are only back a few years ago in 2012!

If you have listened to the wise advice at that time and sold everything, here’s what you missed:

Source: Ycharts

Interesting isn’t it? I’m not saying the stock market will climb another 60% over the next 4 years, but I want to show you that it’s impossible to time the market. I have yet to find someone who went cash and got back into the stock market over the past 10,15 or 20 years and was always right. If you did this, please share your knowledge with us.

Leave A Comment