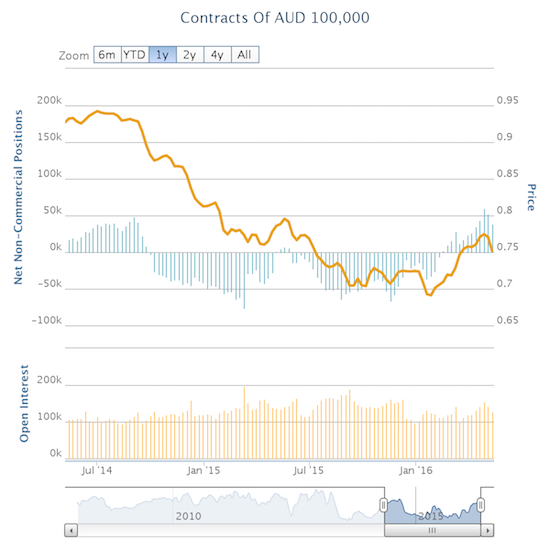

In the wake of poor inflation data, a rate cut from the Reserve Bank of Australia (RBA), and then a dovish Statement on Monetary policy, speculators decided that this was not the time to have such a large net long exposure to the Australian dollar (FXA).

Speculators back off net longs for the second straight week

Source: Oanda’s CFTC’s Commitment of Traders

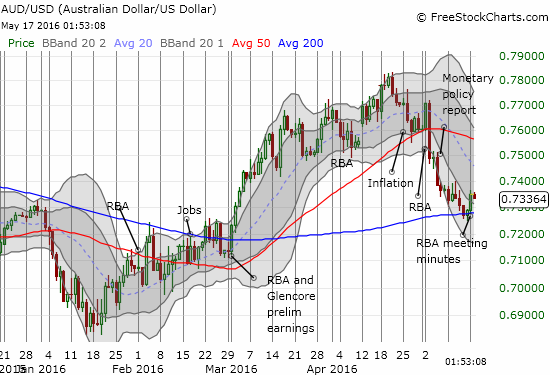

Roll forward to May 16th – the Australian dollar rallied afresh in the wake of the release of minutes from the RBA’s last policy meeting. The text was very consistent with the announcement from the meeting and was not nearly as informative as the Statement On Monetary Policy that followed a few days later. So to explain the rally I have to default to the standby of “market expectations.” I am guessing market participants feared the minutes could contain clues to more rate cuts around the corner. The minutes contained no such language.

The RBA minutes helped AUD/USD find support at the 200DMA. Given the minutes were consistent with info that caused the Australian dollar to slide twice, I doubt this support will hold for long.

Source: FreeStockCharts.com

Here are some key points from the minutes…

Inflation is a real concern for the RBA. The Statement on Monetary Policy included the same commentary on inflation found in the minutes:

“…the CPI data had indicated that weakness in domestic cost pressures had been broadly based. Non-tradables inflation had declined further in March to around its lowest year-ended rate since the late 1990s, reflecting low growth in labour costs and a range of other factors, including heightened retail competition, a moderation in conditions in housing rental and construction markets, and declines in the cost of business inputs such as fuel and utilities…

the lower-than-expected CPI outcome could not be explained entirely by temporary factors.”

Despite the inflation concerns, the RBA is just as confident about the economy as before. Perhaps this confidence comes from its willingness to cut rates to counter low inflation and an expectation that the Australian dollar’s exchange rate will remain low enough to support the economy. The market clearly decided to take the positive spin on this news even though this quote repeats information provided in the Statement on Monetary Policy from almost two weeks ago.

Leave A Comment