In this article we will be reviewing some of the bearish cases for equities since they have overcome the correction earlier in the year and are now near record highs once again. The Nasdaq and the Russell 2000 already beat their January highs, but the S&P 500 and the Wilshire 3000 haven’t. To be clear, it’s not a good idea to be bearish on stocks just because they are at their record high. That’s a terrible argument as bull markets are built on earnings and economic growth. If there is economic momentum and earnings growth, records can be surpassed. You can buy high and sell higher. The purpose of this article is not to be a prediction, but an evaluation of risk.

A Hawkish Fed Is Coming

The Fed is getting more hawkish as it nears contractionary policy, which we define as an inverted yield curve. It’s possible that the Fed funds rate is already high enough to slow economic growth, but the fiscal stimulus is more than making up for this weakness. We will see the effects of this monetary policy when the stimulus begins to decline in impact in the next few quarters. There will be a higher fed funds rate when the stimulus wears off, which could cause an increased dose of weakness. By December 2018, the Fed fund futures say there is a 68.5% chance of at least 2 more 25 basis point hikes. By September 2019, the Fed funds futures show there is a 69% chance of at least 3 more hikes.

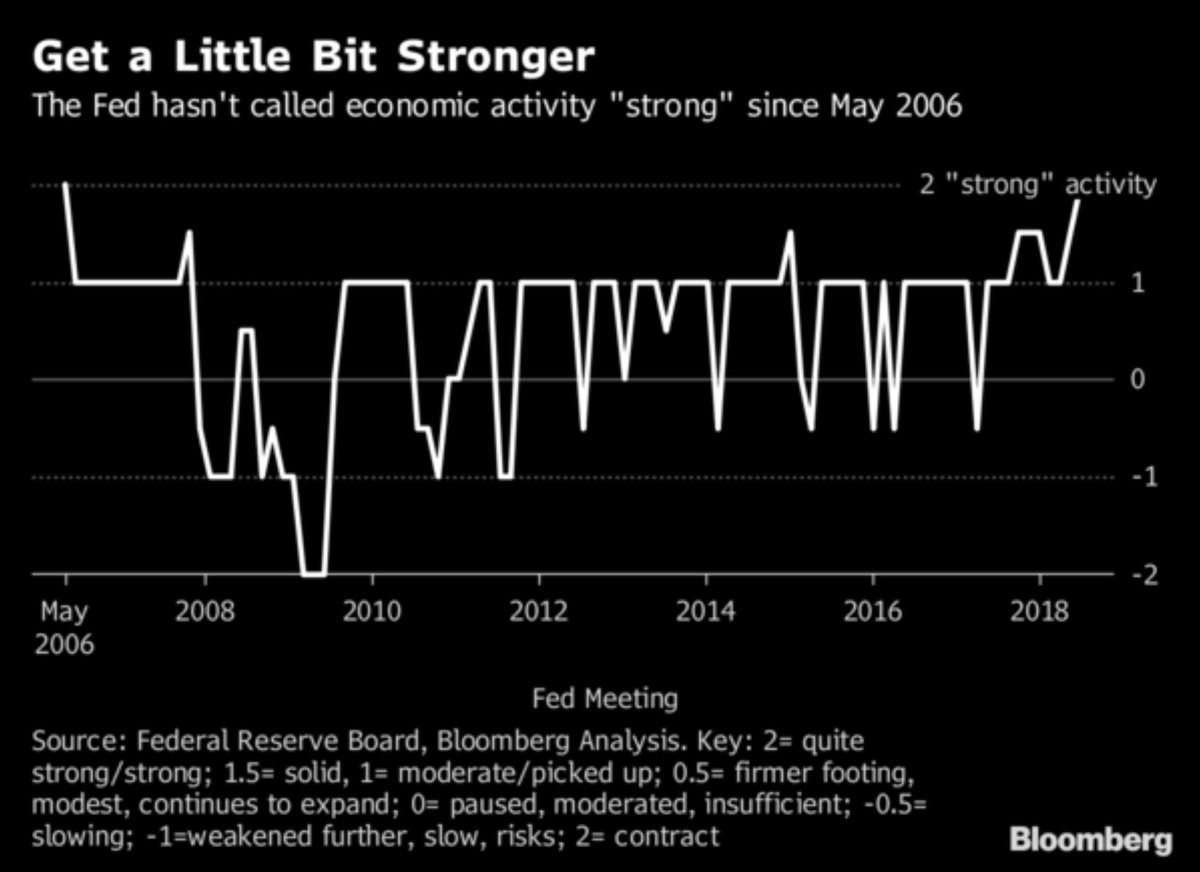

As we get close to the end of this hike cycle, each decision becomes amplified. The Bloomberg chart below shows the Fed’s language in chart form.

Source: Bloomberg

It’s a great visual to show how policy has changed through its language besides interest rate decisions. Forward guidance is very important because it sets the stage for what the Fed fund futures price in. The Fed saying there is strong activity doesn’t sound like much, but it is important because the Fed chooses its words carefully. This is the first time since May 2006 the Fed said the economy is strong. In this case strong is bad because it means the cycle is probably peaking and the Fed feels it can raise rates quickly without pushing the economy into a recession. It took 19 months for a recession to occur after the Fed last said economic activity was strong.

Leave A Comment