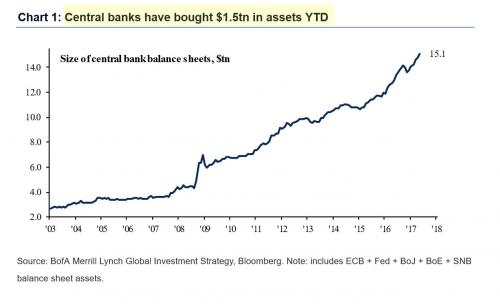

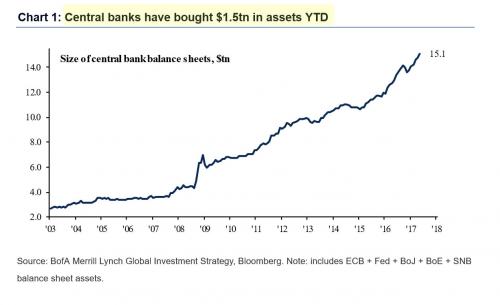

The first half of the year may have been forgettable for a majority of the smart money and hedge funds, with nearly 80% once again underperforming their benchmarks due to months of P&L crushing short squeezes, but it was a buoyant time for equity markets and virtually all asset classes, for one simple reason: a record central bank liquidity injection of over $1.5 trillion YTD. Of course, that central banks had to flood markets with so much liquidity as the global economy is allegedly recovering is the main reason why nobody actually believes in said “recovery”, and neither do the central bankers.

They did succeed however in generating outsized returns for the first 6 months of 2017, and as Deutsche Bank’s Jim Reid writes, the first half of 2017 has been an overall positive half year for our sample of assets. Reid continues below:

Indeed with measures of volatility for a number of asset classes at historically low levels, 32 out of 39 assets in our sample have delivered a positive total return while 35 assets have done similar in USD terms. In summary, equity markets have led the way with 9 out of the top 10 positions in our leaderboard. The peripherals stand out the most with the Greek Athex (+40%), IBEX (+24%) and Portugal General (+22%) all delivering decent double digit returns. European Banks (+20%) have extended a rally which started this time a year ago following a torrid start to 2016. EM equities (+19%), Stoxx 600 (+17%) and the S&P 500 (+9%) have also seen a more than solid start to the year. For bonds, in USD terms returns sit in the +2% to +9% range with the peripherals outperforming.

It’s worth noting that given the Euro has rallied some +9% this year, in local currency terms European Bond markets are actually mostly flat to modestly down for the year. Meanwhile for credit, returns for European indices are +9% to +13% in USD terms (and 0% to +4% in local currency terms) while returns for US credit are +3% to +6%. Finally, similar to the below for June and Q2, Oil stands out for the biggest underperformer in H1 with Brent and WTI down -17% and -14% respectively with the market still questioning the effectiveness of the major producer supply curb.

Leave A Comment