It’s not exactly dead, but the pace of U.S. economic growth since 2009 could rightfully be called morbid.

That’s because the prime movers of economic activity – consumers – are acting like the walking dead.

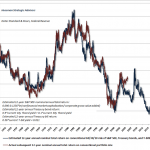

Since 2009, the United States’ GDP (the total value of everything produced by all the people and companies in the country) averaged annual growth of only 1.3%.

The average annual growth rate from 1990 to 2000 was 3.3%. Compared to that, current growth (only 1.2% in the first quarter of 2017) looks like more of the same slow slog we’ve been suffering through.

What’s really killing the economy?

Here’s the sad truth about half-murdered American consumerism, and how to make money on the few hot spots that are floating the economy now.

A Shrinking GDP, a Rising Debt… and Who to Blame

Since two-thirds of economic growth is driven by consumer spending, something must be wrong there.

In fact, there’s a lot wrong. And what’s wrong can easily, and rightfully, be blamed on politicians and their paymasters. Good old crony capitalists.

Let’s go down the list, shall we?

1) There are fewer good jobs and career opportunities at home.

That’s because a series of bad trade deals exported U.S. jobs to the benefit of giant multinational companies, who, to add insult to injury, leave their profits overseas flooding foreign economies with cheap money to spur consumer spending abroad.

2) Health care costs are out of control.

Thanks to bad politicians, who probably still haven’t read the Affordable Care Act they signed into law, a lot of money spent on healthcare would otherwise be spent elsewhere in the economy.

3) Student loan debt is fast approaching $2 trillion.

Once again, thanks to politicians pushing higher education as a means to a better future, while the Fed keeps rates low and crony capitalists make loans easy to access. Enslaving not only student borrowers but their parents and relatives as well diverts consumer spending.

Leave A Comment