The best monthly dividend stocks provide predictable, growing income. With 550 consecutive monthly dividends paid and 74 consecutive quarterly increases, Realty Income (O) is one of the most dependable dividend-paying stocks in the market.

If the valuation is reasonable, these are the types of companies I like to own in our Conservative Retirees dividend portfolio.

Let’s take a closer look at Realty Income to see if it can make the cut.

Business Overview

Realty Income was founded in 1969 and is a real estate investment trust (REIT) with more than 4,600 properties located across 49 states.

Almost all of the company’s properties are single-tenant and are leased to 243 different commercial tenants doing business in nearly 50 different industries.

Retail properties account for close to 80% of Realty Income’s total rent, and all of its properties are under long-term triple-net lease agreements, which provide solid cash flow visibility and shift property operating expenses such as maintenance, utilities, insurance and taxes to the tenant.

In other words, the rental revenue received by Realty Income has substantially fewer expenses and more stable net cash flow compared to REITs with a smaller mix of triple-net leases.

Business Analysis

It’s no secret that few companies have maintained as strong of a dividend growth track record as Realty Income.

The company’s success is driven by its diversified portfolio, disciplined capital allocation, focused business strategy, and strong financial health. These factors have combined to create an extremely resilient business.

Realty Income’s long-term growth has been nothing short of outstanding. Since 1994, the company has grown its real estate assets (at cost) from $451 million to $12.6 billion; expanded the number of industries served by its portfolio from 23 to 243; increased its number of commercial tenants from 23 to 243; and boosted its annual revenue from $49 million to over $1 billion.

Management’s growth strategy over this time has been very focused. The company leverages its relationships with tenants, property developers, brokers, investment banks, and other parties to source acquisition opportunities with strong initial cap rates and built-in rent growth.

Realty Income will only purchase freestanding, single-tenant properties located in big markets and/or key locations that it can lease to tenants with superior credit ratings and cash flows.

The retail business is very much driven by location, and Realty Income’s portfolio clearly plays to this critical success factor.

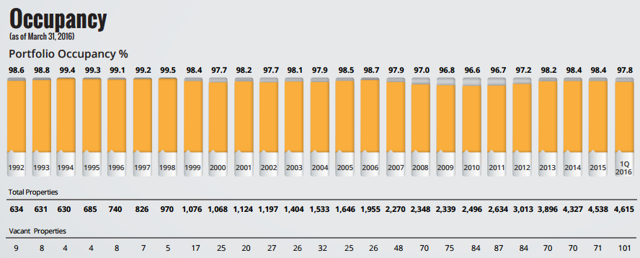

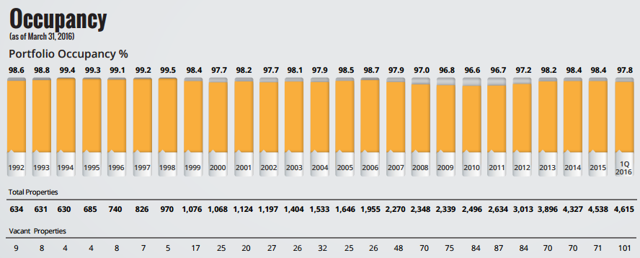

As seen below, Realty Income’s occupancy rate has never dipped below 96.6% going all the way back to 1992.

Source: Realty Income

Sustained high occupancy rates signal the high quality locations of Realty Income’s properties and the financial strength of its tenants. High occupancy rates are also indicative of the switching costs faced by consumer-focused retailers, who don’t want to risk disrupting their established customer base by moving to a new location to save a bit on rent.

Equally important, Realty Income is not betting on any one client or industry for its future success. After all, a high occupancy rate is of little value if a single tenant accounts for a major portion of rent (e.g. 15%+ of total rent) and goes under or decides to walk away after its leases expire.

Realty Income’s largest tenants by rent are Walgreens (6.8%), FedEx (5.3%), Dollar General (4.5%), LA Fitness (4.2%), and Dollar Tree (4.1%).

Its largest industries by rent are drug stores (11%), convenience stores (9%), dollar stores (8.8%), health and fitness (8.3%), and theaters (5.2%).

Leave A Comment