Written by Dirk S. Leach

While most dividend paying stocks that trade on exchanges in the US pay quarterly, there are some stocks that pay their dividends on other schedules.

A handful pay their dividends semi-annually while a there is a larger population of monthly dividend stocks.While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

In my own personal portfolio, the largest portion of my stock holdings make dividend payouts in May, August, November, and February.I have to manage the family finances to ensure those quarterly payments last until the next quarter’s payments.If the majority of my holdings were monthly dividend stocks, it would be easier to manage the family’s cash flow.

As I inferred above, I and my family live off our investment income so I do not use a Dividend Reinvestment Plan (DRIP).We spend most of the investment income our portfolio generates.However, when I was working hard to build wealth, I did use DRIPs often to insure I had a systematic and disciplined investment strategy.There is a small benefit to be gained through monthly compounding in a DRIP versus quarterly compounding.Monthly compounding grows wealth just a little bit faster than quarterly compounding.The chart below provides that comparison.

The chart above shows the annual growth of $1.00 invested in a stock paying a 6% dividend for 25 years.On this scale it is hard to see much of a difference until the period between 20 and 25 years where the red and blue lines diverge.

To get a complete understanding of the benefit of monthly compounding, if you had an initial investment of $10,000 and had reinvested a 6% quarterly dividend (quarterly compounding) you would have $59,693 after 30 years.If the stock was instead a monthly dividend paying stock with the dividend reinvested, you would have $60,226 after 30 years.Every little advantage available should be exploited, especially in today’s market.

17 Monthly Dividend Stocks

You might be wondering why I chose 6% for the dividend rate when so few healthy companies are paying out dividends at that rate.The answer is that there are a number of companies out there that:

A handful of these businesses even have investment grade credit ratings.

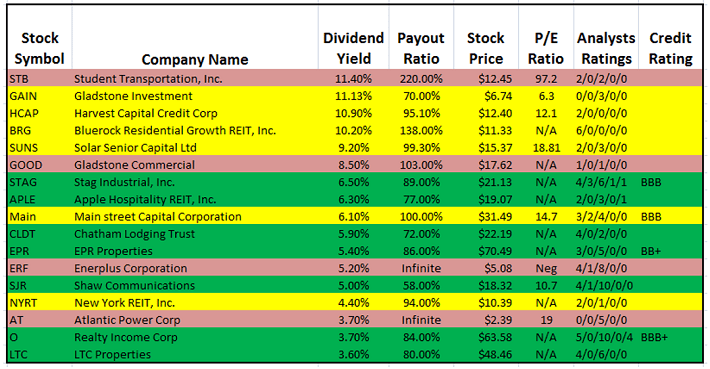

The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

The “Analysts Ratings” column of the spreadsheet should be interpreted as Buy/Outperform/Hold/Underperform/Sell.

For example: STAG with 4/3/6/1/1 would be interpreted as 4 analysts rate STAG as a BUY, 3 analysts rate STAG as OUTPERFORM, 6 rate STAG as a HOLD, 1 analyst rates STAG as UNDERPERFORM, and 1 rates STAG as a SELL.I view analysts ratings as one indicator to consider when evaluating a stock for potential investment versus a definitive metric.

The colors in the chart do have meaning.The stocks highlighted in red are equities that I personally would not currently have in my portfolio.Those stocks highlighted in yellow are stocks that I would consider including in my portfolio under the right conditions and in moderation.Investors need to understand their own appetite for risk and invest accordingly.Those stocks that are listed in green are those stocks that I now have in my portfolio, previously had in my portfolio, or would do so in the future given acceptable valuation metrics.

Readers will note that the top half of the spreadsheet above has more red and yellow.High dividend yields also often indicate there might be fundamental issues with a company’s financials or business prospects and indeed the higher dividend stocks are also at the top of the spreadsheet.

That is not to say that a high dividend is a clear and unambiguous indicator of underlying financial problems but, it should cause an investor to pause and carefully evaluate before committing money.

Rather than rely only on red/yellow/green indicators, I’ve provided a short summary and investment thesis on each stock.

Student Transportation

Student Transportation, Inc. (STB) provides school bus transportation services as well as investment in oil and gas interests. The Transportation segment provides school bus and management services to public and private schools in North America. The Oil & Gas segment represents the company’s investments as a non-operator in oil and gas production in the Canadian Provinces. The company was founded by Denis J. Gallagher on May 15, 1997 and is headquartered in Barrie, Canada.

There are a couple of factors that, for me, make STB not suitable for investment at this time.First and foremost is the difficulty STB has had covering its dividend.The current payout ratio is 220% and STB has not covered its dividend payment for the last few quarters.I expect a dividend cut is forthcoming.

The second negative indicator for me is the company attempting operate in two widely differing types of business; school bus transportation services and investments in oil and gas production.I’m not sure I could devise two more disparate businesses under the same roof.

Gladstone Investment Corporation

Gladstone Investment Corp. (GAIN), a business development company (BDC), invests in small and medium sized companies located in the US, with EBITDA of $3 million or more, positive cash flows, strong competitive position in an industry, liquidation value of assets sufficient to cover debt, and experienced management. It makes debt investments in the form of senior debt and senior/junior subordinated debt and equity investments in the form of common equity, preferred equity warrants for buyouts/change of control, acquisition, growth and recapitalization transactions. GAIN acquires controlling interests with an investment size ranging from $5 to $30 million. It also makes co-investments and may take a seat on the board of directors.

Leave A Comment