In case you couldn’t tell from the ubiquitous political ads and yard signs, midterm elections are right around the corner. Historically, volatility has increased and markets have dipped leading up to midterms on uncertainty, but afterward, they’ve outperformed.

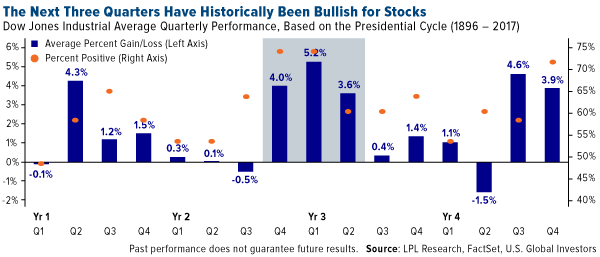

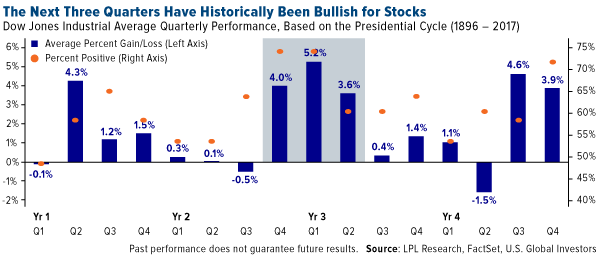

Of especially good news is that we’re entering the three most bullish quarters in the four-year presidential cycle, according to LPL Financial Research. The fourth quarter of the president’s second year in office, which begins next month, and the first and second quarters of the third year have collectively been the best nine months for returns, based on 120 years of data.

It makes sense why this has been the case. Following midterms, the president has been motivated to “boost the economy with pro-growth policies ahead of the election in year four,” writes LPL Financial.

Government Policy Is a Precursor to Change

Should Republicans manage to hold on to both the House and Senate—which Wells Fargo analysts Craig Holke and Paul Christopher estimate has a 30 percent probability—it’s likely they’ll try to pass “Tax Reform 2.0,” with an emphasis on the individual tax side. We can also probably expect to see additional financial deregulation.

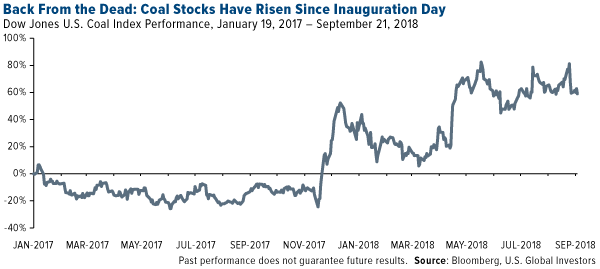

Cornerstone Macro is in agreement, writing that “the better Republicans do in the election, the more confidence investors will have that [President Donald] Trump could be reelected and the business-friendly regulatory practices will remain in place.” A GOP Congress, the research firm adds, would be supportive of banks and energy, specifically oil, gas and coal. Since Trump’s inauguration, the Dow Jones U.S. Coal Index has climbed nearly 60 percent, double the S&P 500’s performance.

The more likely outcome, according to Holke and Christopher, is a divided Congress, with Democrats taking control of the House. In such a scenario, financial deregulation would slow, but Trump, who’s pushed hard for aggressive infrastructure spending, might find the support he needs for a bill from Democrats. This would help increase demand for commodities and raw materials, but “additional stimulus in an economy already near capacity may result in higher inflation, negatively affecting fixed income,” Holke and Christopher write.

Leave A Comment