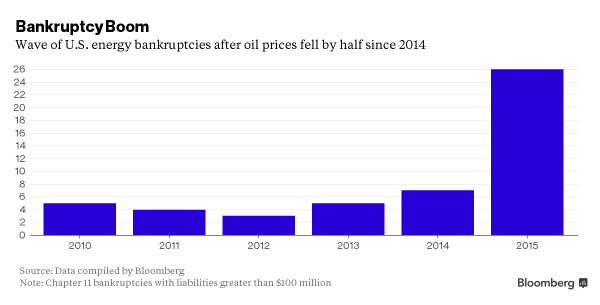

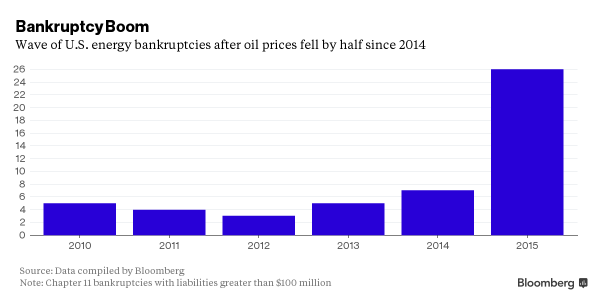

Energy Bankruptcy Boom 2015

Dozens of oil and gas companies went into bankruptcy last year. While energy E&P companies were dropping like flies in 2015, credit rating agencies and banks have remained awfully quiet and apparently buried their heads in the sand.

You see, the Fall Borrowing Base Redetermination by banks on the E&P sector was supposed to take place around October 2015. According to a Haynes and Boone, LLP survey conducted prior to the fall borrowing base redetermination season, industry observers and insiders are predicting a decrease in the ability to borrow against reserves by an average of 39%.

The result of base redetermination does not require public disclosure. Nevertheless, it seemed banks were extremely lenient as the average reduction for 17 companies disclosing the borrowing base reduction results was just 4%. Rating agencies, meanwhile, did not take major E&P downgrade actions till this month in 2016.

It’s About Time!

On Jan. 22, 2016 Moody’s Investors Service said it put 120 oil and gas companies on review for downgrades. Rival Standard & Poor’s Ratings Services was way ahead of Moody’s. S&P said it already downgraded the debt of 165 U.S. companies back in 4Q 2015, representing $1.5 trillion, led by the oil, gas, and commodity sectors. S&P also said for the full year, downgrades rose by 67%, to 461, the highest level since 2009. From late December to January 2016, Fitch also took individual downgrade action on companies such as NGL Energy (NGL), Chesapeake Energy (CHK) and Williams (WMB).

Wall Street’s Lifeline to Frackers

We can see how banks do not want to write off and take a loss from their E&P debt on their books and have motivation to keep feeding the high leverage and not call in the energy loans during the base determination last October.

FT reports that as of September 2015, about a dozen E&Ps already had debts as high as more than 20 times their EBITDA. One of the reasons pushing down oil price to the current historical lows, and yet no sign of decline in U.S. production is that quite a few small frackers need to pump oil regardless (even below the economic threshold) just for the cashflow to pay bills and payrolls.

So the collective action by banks to sustain the life of many weak oil frackers (so banks won’t need to book losses) ironically exacerbated the oil over-supply and price crash speeding up the way for these hanging-in-there frackers to meet their maker.

Leave A Comment