Trading is closed for the CAC 40 today, however traders are looking forward to the resumption of trading this week with a series of high importance economic events. Euro CPI figures and Unemployment data for Germany are set to be the major fundamental drivers for European stocks and exchanges this week. In addition, traders should watch for the US NFP (Non-Farm Payrolls) release on Friday. Expectations are set at 242k for the event, but a strong deviation from this value may directly influence European Indices such as the CAC 40.

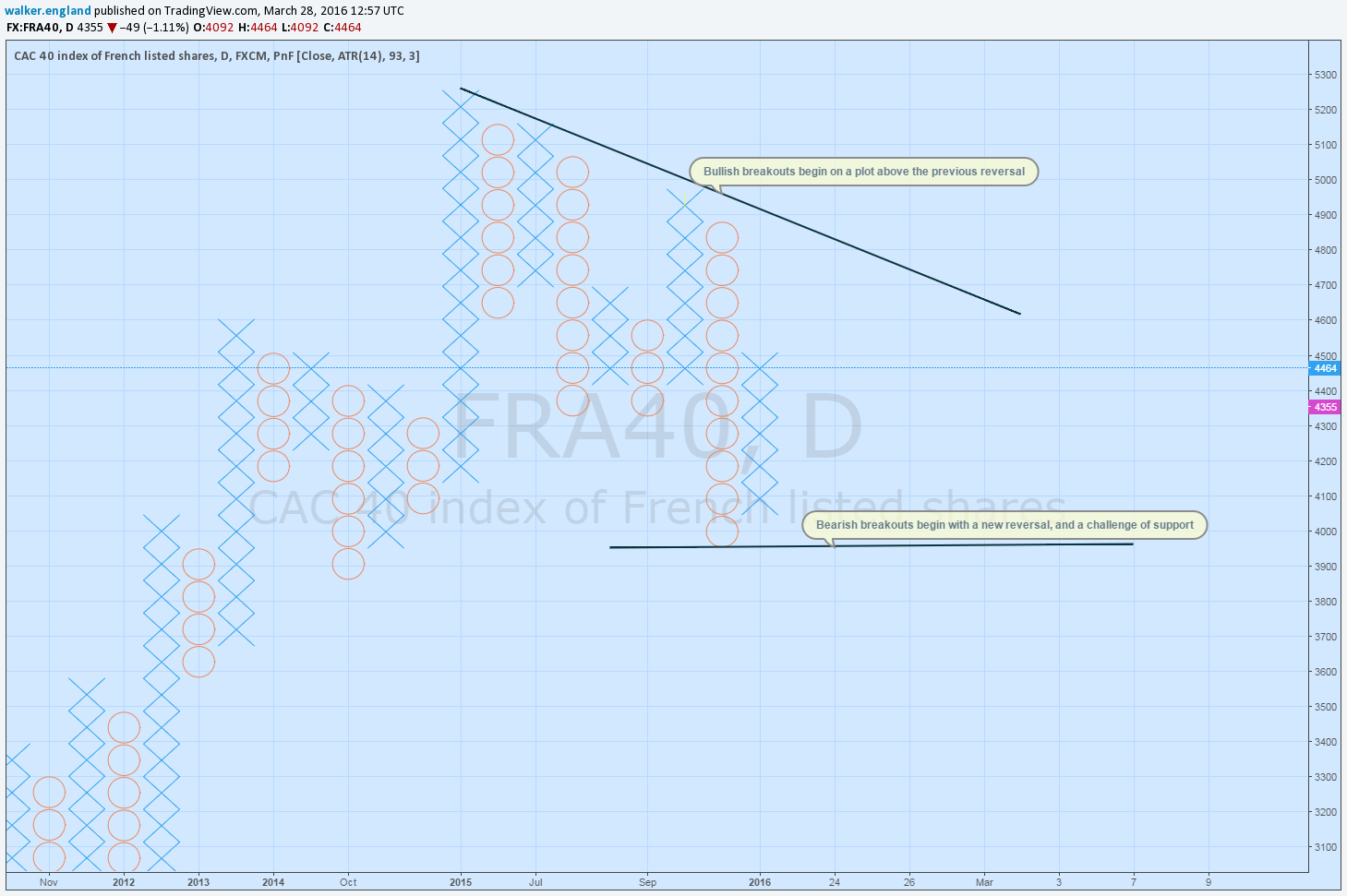

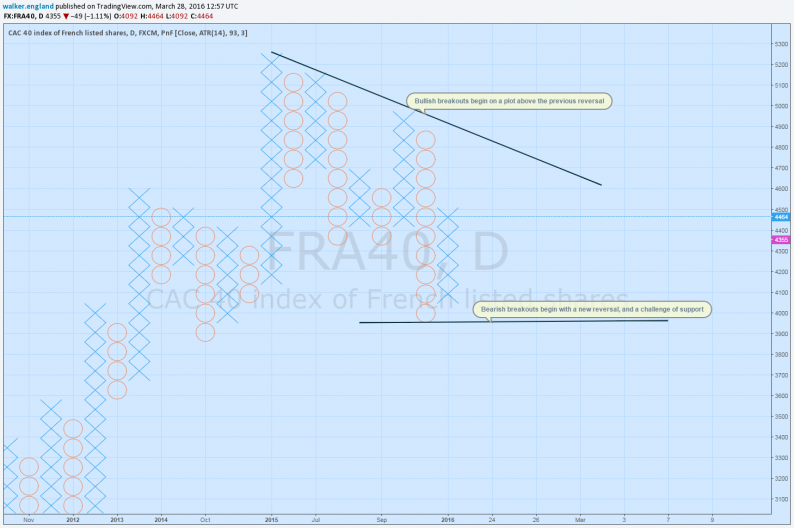

Going into this week’s trading, the CAC 40 technically remains in a consolidation pattern. This ongoing consolidation can be clearly seen using the point and figure chart above; as the pair has yet to significantly break to new highs after February’s bullish three box reversal. With the absence of a new high or low, this presents traders with two distinct possibilities. In the event of a bullish advance, traders will look for the creation of a new bullish box above resistance. Conversely, in the event of a bearish reversal, traders should look for a fresh bearish 3-box reversal and for prices to then challenge existing 2016 lows.

SSI (Speculative Sentiment Index) for the CAC 40 is currently reading at an extreme +3.62. This value is up significantly from last weeks reported value of +1.82. When taken as a contrarian indicator, this suggests that the CAC 40 may be preparing for a future decline. Alternatively, in the event of a bullish advance,traders watching SSI would expect this value to retrace towards values that are more natural.

Leave A Comment