A monkey wrench was just thrown at the financial markets and we can see all stocks around the world reacting to the news. The resignation of Gary Cohn from Donald Trump’s administration is a game changer.

The former investment banker was seen by many on Wall Street to be the last adult in the White House. Cohn joins a long list of high profile dropouts from the Trump Administration.

After battling with the President over the planned Aluminum and Steel tariffs, Cohn finally threw in the towel, a few hours after Trump tweeted that “there is no Chaos, only great Energy.”

Fortunately, from a markets perspective, Gary made the announcement during the downtime when most markets are closed.

For investors, more than the loss of a level-headed banking figure in a much-needed position is the gripping realization that the proposed tariffs are not only a possibility but likely to happen.

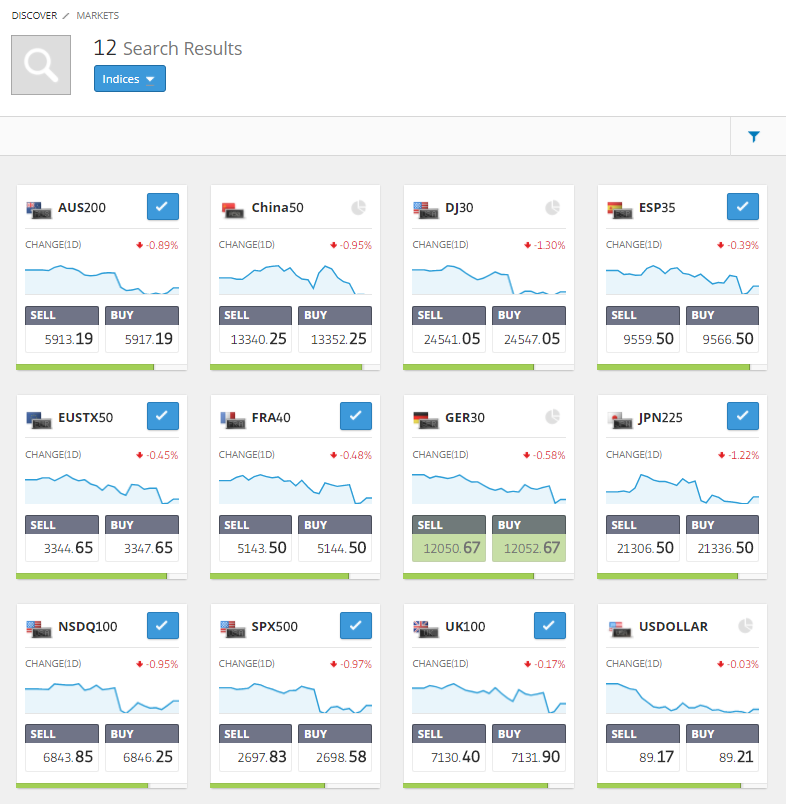

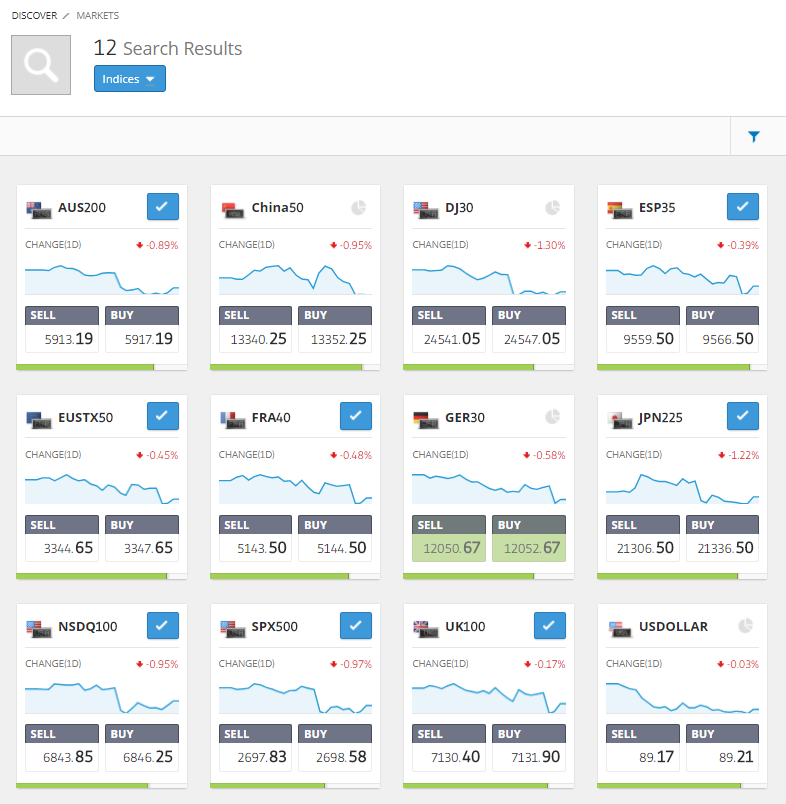

Traditional Markets

Market

Trump’s idea to impose the metal tariffs caused stocks to tumble from Wednesday to Friday (see the yellow box in the graph below). There was a slight recovery on Monday and Tuesday was going fine until Cohn resigned.

Still, put in the wider context even though the Cohn plunge (purple circle) affected many different markets the size of the drop is still small compared to the big sell-off in early February (blue box).

DJ30 Chart

Normally, we would look at an asset like gold to try and gauge if investors are seeking risk or safety, but lately, that’s been out of the question.

This is partially due to the power of the range. (begin segway…

We can see the power of the range being demonstrated at the moment in Silver.

Silver Chart

Notice how for most of last year the price has remained between $15.50 and $18 per ounce. For traders, this is an excellent opportunity because a well-defined range makes it easy to buy low and sell high.

Leave A Comment