To be a smart contrarian you need to have the confidence to dive into unloved areas of the market and sort through the rummage in search of asymmetric opportunities.

Our team at Macro Ops has been digging deep and has finally “struck oil” in the energy market.

The popular narrative driving oil’s bear market over the last 3 years has consisted of two core ideas:

Combine increased supply with decreased demand and of course you’re going to get a drop in prices.

Though this remains the popular narrative, the latest underlying data is telling a different story. And as always investors are slow to react, creating an opportunity for us.

First off, the market is overstating oil’s supply growth.

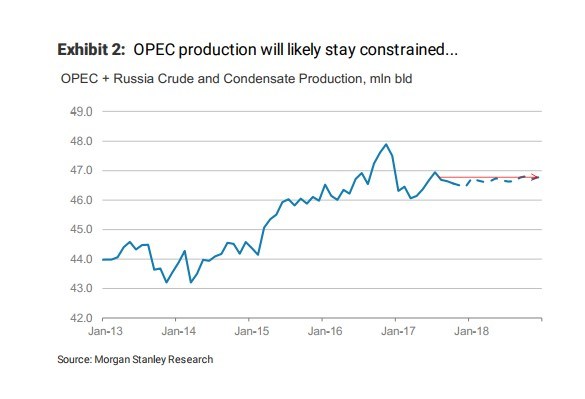

OPEC’s recent decision to extend their current output agreement means production will hold steady into the end of 2018.

And production outside OPEC, Russia, and the US and Canada has been shrinking. Over the last year aggregate production as fallen by 0.3 mb/d. It’s expected this number will fall by another 0.1 mb/d in 2018 as well.

This puts pressure on US frackers to pick up the slack. For them to fill the gap they’ll need to grow their output by 20% in 2018.

But what we’re finding is that shale productivity growth is slowing at an alarming rate. This is because frackers have already pulled the easy oil from their tier 1 properties they’re now having to move on to less productive fields.

In addition, oil companies in the US and the rest of the world have significantly cut their CAPEX over the last 3 years.

Global oil and gas investment, as a percentage of GDP, has collapsed from a cycle high of 0.9% in 2014 to just 0.4% today.

That means CAPEX into future capacity is now less than half of what it was just a few years ago. This makes it one of the largest capex reductions in the global oil and gas space, in history.

Leave A Comment