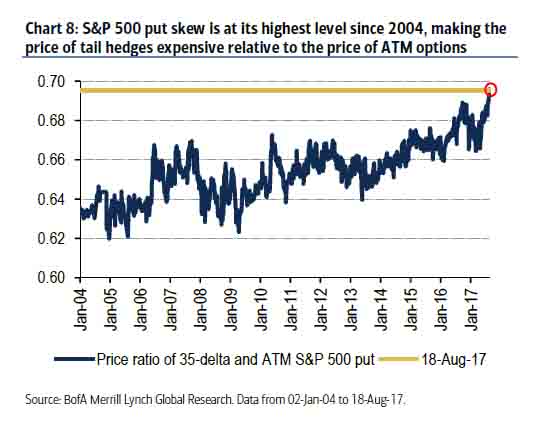

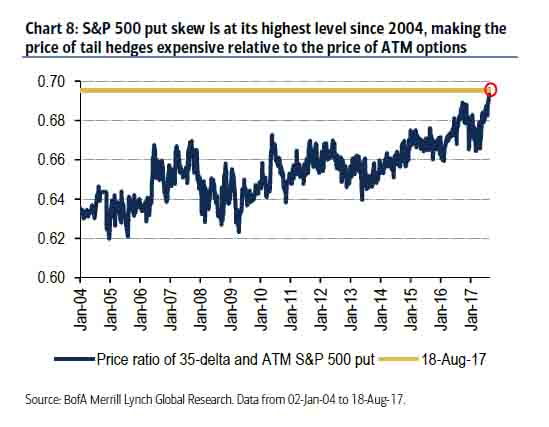

With the VIX surging, and then quickly getting pummeled on two occasions in the past three weeks, dizzy traders could be forgiven to assume that any latent “risk off” threat, whether from North Korea or the US political front, has been taken off the table. However, a deeper look inside the vol surface reveals something very different: with increasingly more analysts and traders warning that volatility is set for a sharp return this fall, equities have already been adjusting to the increased probability of a “tail event.” However, instead of buying VIX futures, call or ETPs, they have been doing so by bidding up the price of OTM equity put options, or equivalently, by steepening the S&P 500 put skew and.

As a reminder, a put skew shows how much more expensive it is to buy deep OTM puts vs puts that are in the money or in other words, a levered bet on (or hedge against) a market crash.

And as the following chart from Bank of America shows, the S&P put skew is now at the highest level on record, making the relative price of tail hedges the highest in 13 years as traders are quietly bracing for a sharp market crash.

While not new, Bank of America again underscored the potential risk in the coming months to actively managed portfolios from a possible volatility flaring event, primarily impacting risk-parity portfolios. This is what the team of BofA Benjamin Bowler wrote in an overnight note:

Both equity and bond valuations are high. In a report from last week, our equity strategists pointed out that the S&P 500 forward P/E expanded in July and hit its loftiest level since the Tech Bubble. Even at these elevated levels, equities look attractive relative to bonds whose risk premium is more than 50% above its long-term average. This is clearly a concern for portfolios that invest in both classes (risk parity). A significant risk for multi-asset managers going forward is a breakdown in the diversification between stocks and bonds in which we see simultaneous declines in both asset classes similar to the ‘Taper Tantrum’ in May/Jun-13 or to a slightly lesser extent the risk-off event from Aug-15 two years ago. It may be surprising to an equity investor, but for a multi-asset manager these two declines were the largest since 2008 and equal to 50% of the drawdowns from the GFC. With multi-asset vol so low, for those managers who use leverage, the leverage levels may be high and therefore their portfolios may be more sensitive to a breakdown in correlation.

Leave A Comment