We are on the verge of moving into an era of high interest rates, so markets will behave differently from any time since the early-1980s. There are enough similarities with the post-Bretton Woods era of the 1970s to give us some guidance as to how markets are likely to evolve in the foreseeable future.

The chart above says much. Last week, the yield on the 10-year US Treasury bond broke new high ground for this credit cycle. The evolution of key moving averages in bullish sequence (for higher yields, but sharply lower bond prices) is a model example out of the chartist’s textbook. The underlying momentum looks so powerful that a quick rise to 3.5% and beyond appears to be a racing certainty. The credit cycle, transiting from a period of cheap finance into higher borrowing costs, is clearly on the turn.

In the fiat-money world, everything takes its valuation cue from US Treasury bonds. For equities it is theoretically the long bond, which is also racing towards higher yields. Having ignored rising yields for the long bond so far, the S&P500 only recently hit new highs. It has been a fantasy-land for equities from which a rude awakening appears increasingly certain. It is likely that the current downturn in equity prices is the start of a new downtrend in all financial assets that have been badly caught on the hop by the ending of cheap credit.

At some stage, and this is why the bond-yield break-out is important, we will face a disruption in valuations that undermines the relationship between assets and debt. This has been a periodic event, with central banks taking whatever action was needed to rescue the commercial banks. When the crisis happens, they reduce interest rates to support asset valuations, propping up government bond markets and ultimately equities. These actions are intended to rescue the banks, allow governments to fund their deficits, and to encourage recovery by stimulating an expansion of bank credit, which last time was bolstered by quantitative easing. Central bank rescues have succeeded every time so far, after some tricky moments, not least because we all want them to work.

There is a widespread feeling that a new unspecified crisis is in the wings, usually attributed to the latest signs of financial instability or economic weakness. Whether it is Italy, China’s debt, slowing money supply growth, or a flattening yield curve, they’ve all been identified as triggers or portents. Even as recently as six months ago, the pessimists seemed convinced the US economy was stalling, when it turned out to be robustly strong.

In general, central banks are adept at defusing individual problems. But there’s one difficulty central banks cannot deal with, and that’s the credit cycle, which they themselves create through their earlier inflationary actions.

Enough has been written about this under Austrian business cycle theory (which for accuracy’s sake should be renamed credit cycle theory) without repeating it here. But instead, central bankers are committed to Keynesian assumptions that capital structures are fixed, and that interactions between interest rates and capital allocation can be safely ignored.

The proof of this error is seen in the generation of the credit cycle described by the Austrian school, which once embarked upon is impossible to control. It leads inexorably to a temporary boom followed by a credit crisis. As I concluded in an article published last February, “we will be lucky if the next credit crisis, taking all this into consideration, does not strike before the year-end “.[i]

I still stick with that time scale. This article updates the February essay, and is a dissertation on how the crisis stage of the credit cycle is likely to evolve. We will take this to be from the beginning of a widespread bear market in financial assets that leads to economic disruption. It compares well with the underlying situation for global finances with the 1970s, which started with a dollar crisis, leading to the end of Bretton Woods system in 1971. Commodity prices, particularly oil, rose multiple times, which appears to be happening again today. Importantly, the benign interest rate environment of the mid-1960s came to an end, replaced by official interest rates in double-digits, and there was a developing loss of public confidence in unbacked government currencies.

There are enough alliterations and rhymes between then and now to form the basis of a thesis of what lies ahead.

The era of low interest rates is over

Since the turn of this century there have been two credit crises, 2001/02 and 2008/09. These have occurred against a background of declining rates in the longer-term. It suited everyone. The world’s total of government, non-financial corporate and consumer debt increased from $64 trillion in 2000 to $105 trillion in 2008. Today it is probably about $186 trillion, excluding financial sector debt and shadow banking.[ii] The rate of growth of global non-financial debt is similar to the growth of global nominal GDP, which simply reflects money supply growth applied to the non-financial economy. And with declining interest rates over the longer-term it has expanded greatly.

The steady relationship of debt to GDP tells us the height of the debt mountain is as might be expected in this inflationary situation. Therefore, it is not the overall size of the debt that will trigger the crisis. Nor is it the cost of servicing it that’s the immediate issue, because much of it is fixed interest with some time to run before it matures, and a wise borrower would have used low, or even zero interest rates to refinance into longer maturities.

For the commercial sector, the most important issues by far are the marginal cost of working capital and the interest-rate assumptions backing corporate business plans. Even if a corporation has net cash, it will have set a hurdle rate for a return on its capital. Those calculations are now being revised for higher interest rates, making earlier investments appear less profitable. For the moment, a business might decide to sit out higher rates rather than imperil earlier commitments. But prices, that all-important input factor for manufacturing, are rising as well, gradually destroying margins.

As interest rates and bond yields rise further and equity markets start falling, businesses that have seen their earlier profit assumptions being undermined are bound to again revise their business plans. Lending banks will sense the mood-swing and in turn become cautious. Central banks in their surveys will find the business atmosphere deteriorating. But they will face a dilemma: price inflation is rising at an accelerating pace and reflating too early will make it worse. Will they make the same mistake as the Fed did in 1927? That year the economy appeared to enter a mild recession, the Fed lowered interest rates to sustain rapid growth, and the stock market overheated then crashed in 1929.

The temptation for central banks to wait and see at this point must be strong. With this cycle there can be little doubt US bond yields are signalling a significant acceleration of the bond bear market. It is a feature of major bond bear markets that the initial default sentiment, whereby investors broadly accept what they are told by central banks and government agencies as true, is replaced by increasing scepticism. And if there is one understated issue likely to cause investors to rethink, it is the true condition of the economy. Central to its reappraisal is the price deflator, used to adjust nominal GDP, wages and pensions for price inflation. Turning into bearish sceptics, bond investors will no longer be satisfied with yields that reflect an exceptionally low or even a negative real return. Instead, they will begin to expect compensation for the loss of the purchasing power of their capital, and they will make their own assessments in this regard.

This is why yields on US Treasury bonds are rising today and look set to rise considerably further. And this is the vital point: the US has low interest rates, but no longer a low interest rate economy. As the rate of price increases for goods and services accelerates, driven by continuing fiscal deficits and monetary stimulus, investors are likely to question official inflation figures, something currently taken as correct.

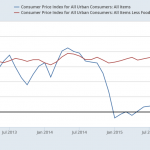

Raw data consisting of a fixed basket of goods as a measure of a constant standard of living differs substantially from the CPI. The CPI has become a basket-based index of goods and services which is continually changing, reflecting substitution, decreasing quality and hedonics. This is why the CPI significantly understates the rate of price inflation, while a constant standard of living index already shows annualised price inflation to be closer to 10%, an approximation that has persisted for a number of years.

If investor sentiment wakens to this reality, the era of super-low interest rates we all take for granted will be over. This is a very real danger. It will be replaced by rates and bond yields that seemed appropriate over forty years ago. As the late 1960s and 1970s progressed, interest rates began to rise as currency imbalances normalised, resulting in the post-war Bretton Woods Agreement being abandoned. Today, currencies have not even a fig-leaf of gold cover, but the currency imbalances are a common feature.

Leave A Comment