For 88-year-old Vanguard founder Jack Bogle, there is no better place to be invested right now than the U.S. and he’s “all in” with his portfolio split between U.S. equities and bonds. In an interview with Bloomberg, Bogle makes the rather surprising argument that buying U.S. equities at record highs is a contrarian play.

“I believe the U.S. is the best place to invest,” Bogle said in a telephone interview. “We probably have the most technology oriented economy in the world. I would bet that the U.S. will do better than the rest of the world. It is a simple bet on which economy is going to be the strongest in the long run.”

“Every single person I think I have ever talked to tells me I am wrong in this,” Bogle said. “If you believe in the majority, you can just throw my opinion in the waste basket. But on the other hand, I was brought up in this business and I am saying ‘the crowd is always wrong.’”

“I don’t think in the long run [emerging markets] will do as well as the U.S.,” he said. “They are more risky and more sensitive to interest rates, more sensitive to Federal Reserve statements and actions. They don’t have the diversity we have in the U.S.”

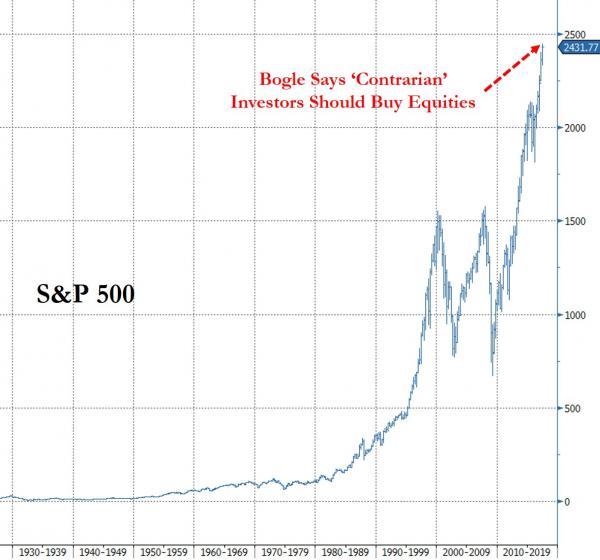

Of course, while he makes the argument, we’re not quite convinced that investing at peak multiples and with the S&P trading at all-time highs is ‘contrarian.’

And another ‘contrarian’ indicator:

But sure, the ‘crowd’ hates U.S. equities right now.

Leave A Comment