What you’re hearing about startup land is sometimes not what’s actually happening.

Below are five charts that prove this point, starting with perhaps the biggest surprise of all…

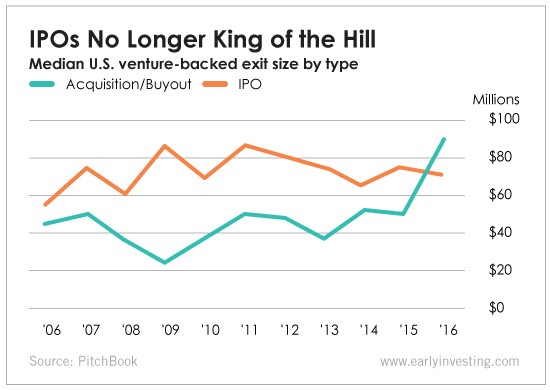

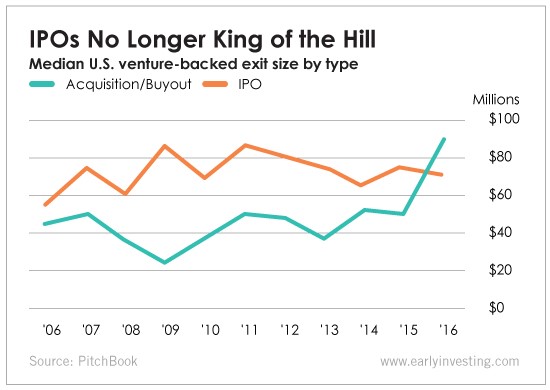

For the past decade, when the best companies have gone for the ultimate exit in size and prestige, they chose to IPO. In the most surprising development of the last year or so, we’ve seen the size of buyouts exceed the size of IPOs.

What’s happening?

It’s certainly a comment on the huge cash reserves of mega-tech companies like Apple and Google that can afford mega-acquisitions. But something else is going on: The largest Unicorn startups are in no hurry to IPO. And that will continue to be the case as long as they’re able to pull in large amounts of investments.

Case in point? The $3.5 billion Uber received from Saudi Arabia’s investment fund last year.

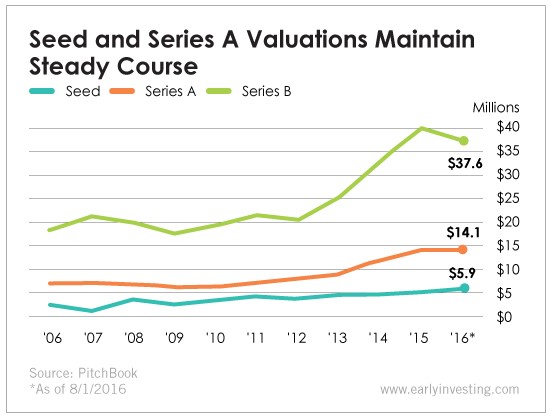

There’s lots of talk about valuations going through the roof. As far as the early stages go, that’s only true for Series B companies. As you can see, they corrected in 2016.

Seed valuations continue their steady climb. There’s no denying you’re paying more now than you were 10 years ago. But if valuation inflation is real, so is expectations inflation. These days, more progress is expected from seed companies than there was 10 years ago. The risk-reward ratio has skewed to less risk and slightly less reward.

Of course, if these seed companies hit it big, you’re still going to make out.

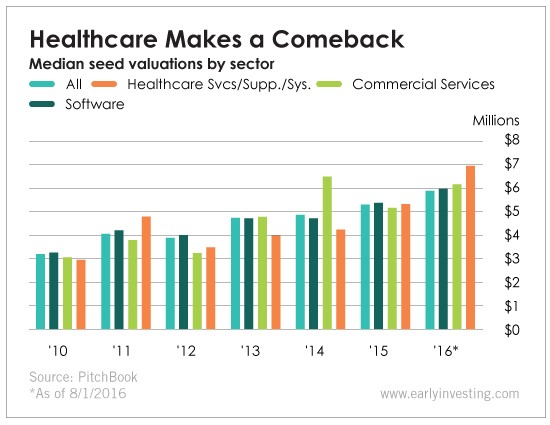

Two things to take note of here.

One, valuations continue to rise across all major sectors.

Two, look at 2016. After a five-year break, healthcare has once again taken the lead in seed valuations. Those 2011 healthcare seed companies had trouble becoming profitable, but investors believe the current wave of medtech innovation represents bigger and better market opportunities. I agree.

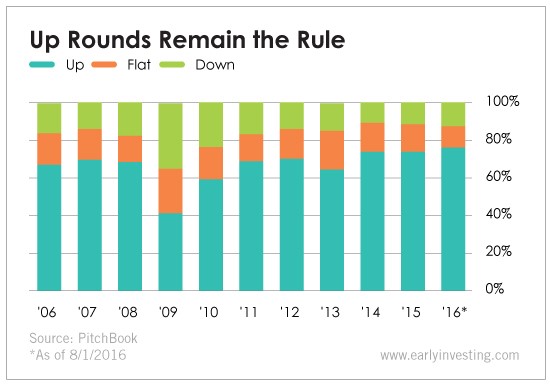

So much for all those panicky stories about down rounds (where share prices drop lower compared to the previous round). We’re not seeing the second coming of 2009 or even 2010. Last year, 76% of venture capital financings received a higher valuation than they did in the previous round. Unless interest rates shoot up, this year should boringly fall into place.

Leave A Comment