Why you should hope the Fed hikes again in 2016…

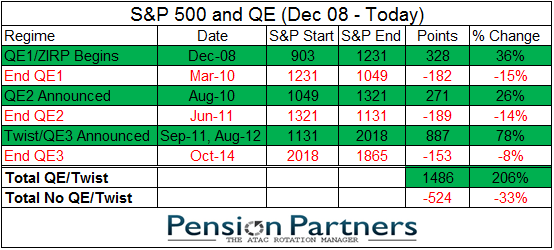

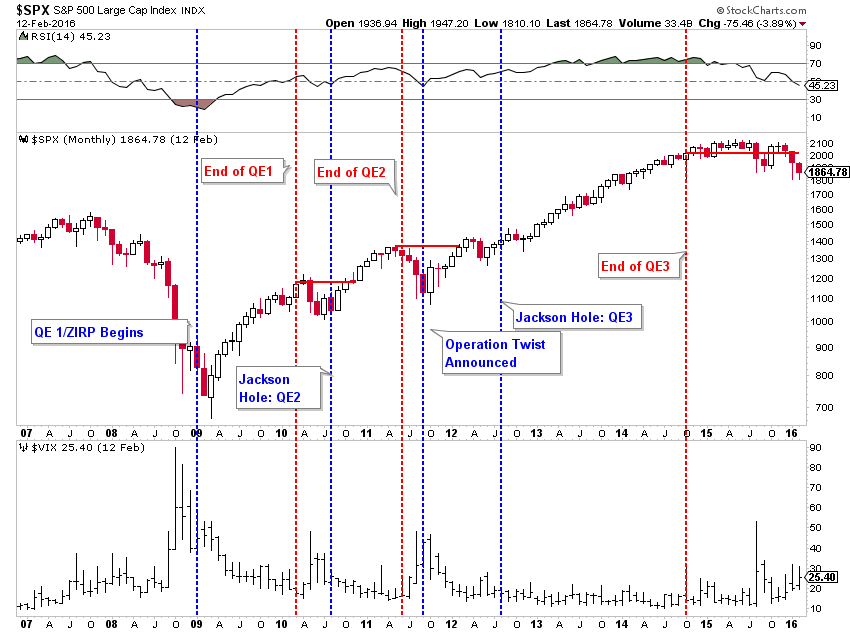

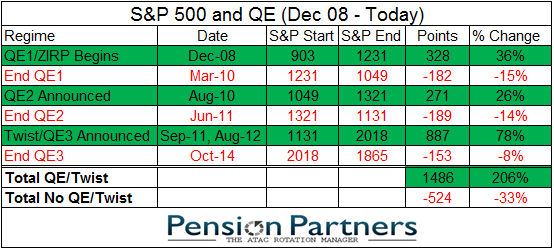

Like Pavlov’s dog, market participants seem to salivate with any mention of quantitative easing (QE). For good reason, I suppose, as they have been conditioned to believe that quantitative easing means higher stock prices. Indeed, since QE1 was launched in December of 2008, all of the gains in the S&P 500 have come during periods in which QE has been in place.

The sharp declines in the S&P 500 during 2010 and 2011 occurred during periods without QE, and were soon followed by additional easing. Since QE3 ended in October 2014, the markets have struggled again, leading some to call for additional easing once more. In fact, market participants are currently not expecting the Fed to hike again until 2018 (according to Fed Funds Futures).

But this is not 2010 or 2011 and market participants should be careful what they wish for in asking for more QE this time around. Why? The easy money game has changed. With the Fed hike in December 2015, the path towards normalization has commenced. To reverse course on that path would be a grave admission of failure on the part of the Fed, likely requiring a recession to do so.

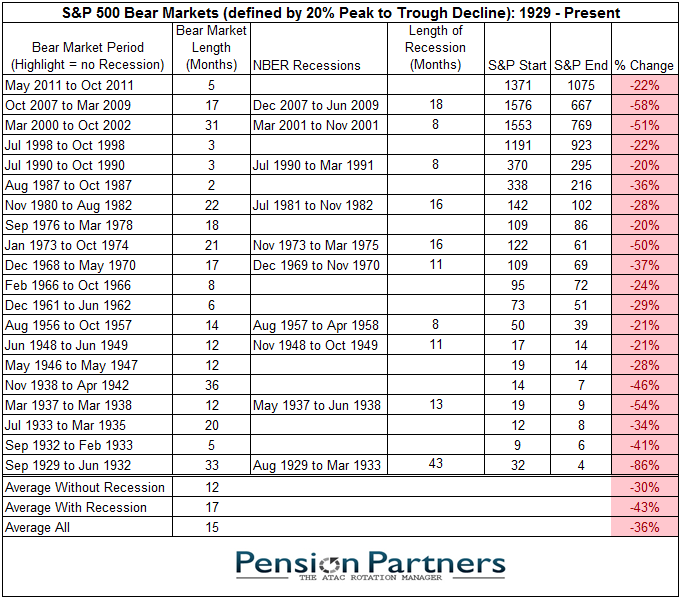

And a recession likely means additional stock market losses, as we observe in the table below showing the average recessionary bear market decline of 43% (vs. the recent correction of 15%).

I have no doubt the Fed would “act” with either a rate cut, more quantitative easing, or both should another recession unfold in 2016. But such an action would take place at much lower stock prices. Which is why I started the piece in saying you should actually want the Fed to hike in 2016 because it will have meant that the markets stabilized and the U.S. avoided recession (the Silver Linings Playbook).

But what if the Fed doesn’t wait?

I know what you’re thinking. The Fed should just act now with a rate cut and more QE. That way they can prevent another recession and further stock market declines. This come as a surprise to new market participants, but the Fed cannot repeal the business cycle. Once the cycle has turned, easy money is no panacea.

Leave A Comment