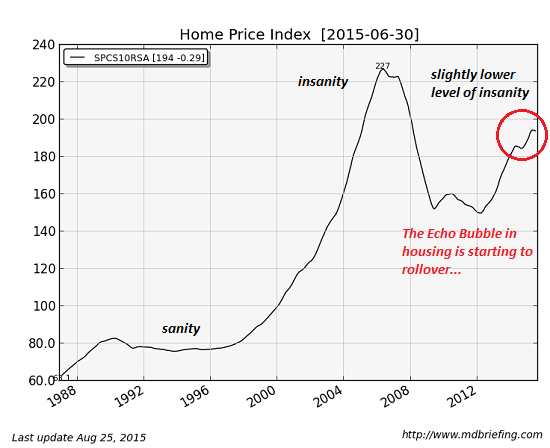

The Federal Reserve-induced Echo Housing Bubble is finally starting to roll over, and the bubble’s pop won’t be pretty. Why is the bubble finally popping now?

All the factors that inflated the Echo Housing bubble are running dry. These include:

— unprecedented low mortgage rates

— FHA mortgage approvals for anyone who fogs a mirror

— frantic cash buying by Chinese millionaires desperate to get their money out of China

— the Federal Reserve buying up trillions of dollars in mortgages

— lemming-like buying of housing for rentals by everyone from Mom and Pop to huge hedge funds.

The well’s gone dry, folks. There isn’t going to be another push higher or a third housing bubble after this one pops.

Let’s start with the basics: demographic demand for housing and the price of housing. There are plenty of young people who’d like to buy a house and start a family (a.k.a. new household formation), but few have the job or income to buy a house at today’s nosebleed level–a level just slightly less insane than the prices at the top of Bubble #1.

Charts courtesy of Market Daily Briefing)

It’s considered bad form to describe today’s prices as insane. It tends to hurt the feelings of everyone who’s counting on the Echo Bubble to 1) make them even richer or 2) bail them out of the hole they fell into after Housing Bubble #1 popped.

Exhibit B is the insanely low mortgage rate, which has finally reversed course and is notching higher after 30 years of going lower. Why are today’s rates insane? Risk. Mortgages are intrinsically risky. People who are terrific credit risks lose their jobs, experience horrendous medical crises, get divorced, etc., and the net result is a default that is unexpected.

Then there’s all the credit-rating-of-501 crowd that was always one missed paycheck away from defaulting on their FHA/VA mortgage. Once the layoffs begin scything through Corporate America and struggling small businesses, those living paycheck to paycheck buyers of Echo Bubble housing will have no choice but jingle mail the keys to the bank.

Leave A Comment