It’s not getting much airplay, but on Friday, a rather important factor to the incessant U.S. financial asset bid expired.

According to Bloomberg’s Brian Chappatta, Friday was the last day U.S. corporations could deduct pension contributions at the 2017 corporate tax rate of 35 percent and will now only be eligible for the new 21 percent rate.

There has been considerable debate amongst the fixed-income community regarding the amount of curve flattening that has been the direct result of corporations accelerating their pension contributions. In fact, Brian’s article is named, “The Yield Curve’s Day of Reckoning is Overblown” and is mostly a rebuke of the idea that this factor has been the driving force to the recent flattening.

I don’t agree with all of Brian’s conclusions – but hey – that’s what makes a market!

The U.S. has been flattening at a vicious pace, while most other major bond market curves have been treading water.

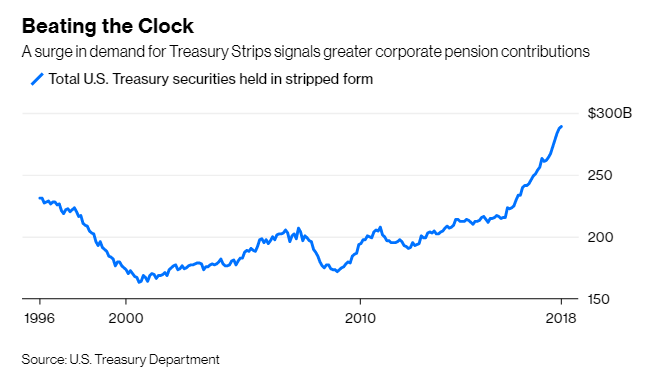

And as Brian points out, there has been a tremendous demand for U.S. fixed-income from pension funds:

I love the steepener trade for a variety of reasons so I need little excuse to be bullish on the yield curve, but I wonder why bond traders are the only ones talking about the pension contribution deadline. Last I checked, most pension funds hold bonds and equities in their portfolio. Surely if corporations are accelerating their pension fund contributions, then this will also affect U.S. equities.

Now there is absolutely no way this pension contribution acceleration has been solely responsible for the unbelievable U.S. equity performance over the past six months, but can we be sure it hasn’t at least contributed to the amazing run from U.S. financial assets? And now that it is ending, what does that mean going forward?

Not just the pension contribution acceleration that has pushed U.S. assets higher.

Leave A Comment