After the FED’s decision of 17th September leaving interest rates unchanged, a great confusion has spread throughout the markets. The varied opinions have oscillated from the “disappointed” who were expecting, if not a rate increase, at least clear commitments towards a steady normalization path and the “crypto-hawks”, that have been arguing that the FED was only temporarily retreating only to accelerate the hike cycle in the following months. To be sure, Yellen and her spokespersons have not helped the markets to form a solid idea, by alternating contrasting declarations over just a week or more. Whatever the case, a view is crystallizing in the markets: the coming rate increases will be significantly smaller. This also holds true in the long term.

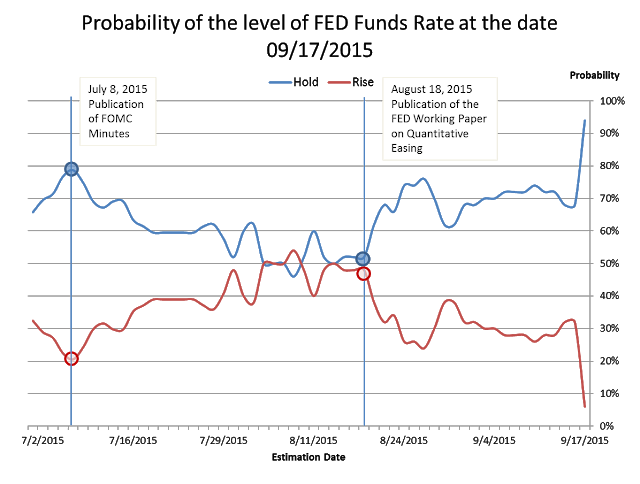

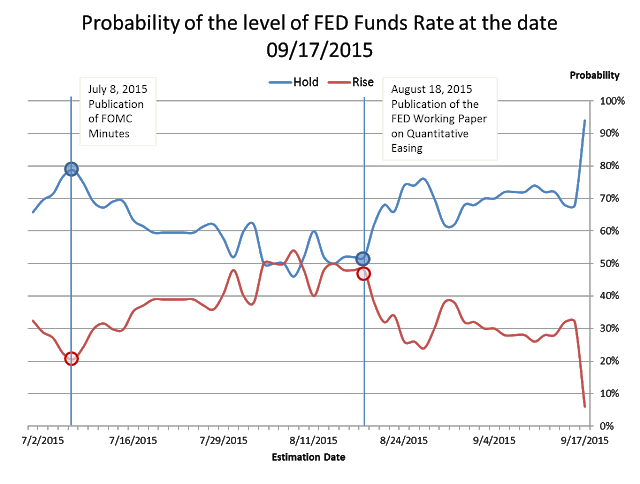

By looking retrospectively at the data, we have to admit that the “hold” decision was not unexpected at all by the markets (Figure 1).

Figure 1.

Leave A Comment