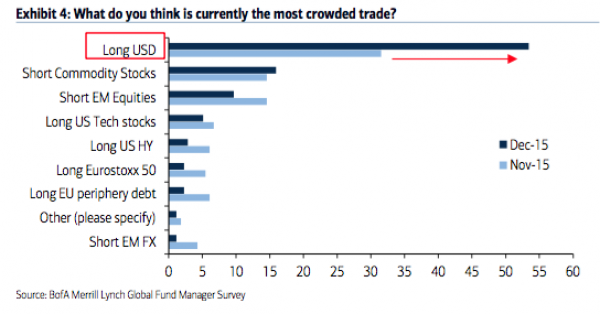

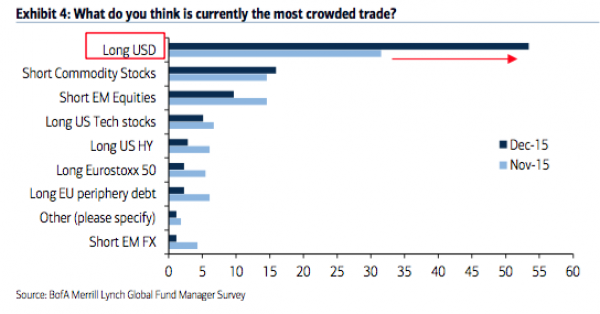

The “long dollar” trade may be the most crowded ever…

…but that doesn’t mean there aren’t disagreements where the greenback goes from here, especially after the Fed’s historic first rate hike which according to some means the end of the dollar’s tremendous year-plus long rally as the market starts to price in the next recession as a result of the Fed’s own action, while according to others as a result of rate differentials and other central banks’ ongoing debasement of their own currencies, the dollar surge is only getting started.

Among the latter, is none other than infamous Goldman FX strategist Robin Brooks, whose recent firm conviction that the ECB would crush the EUR led to massive losses for anyone who listened. This time, Goldman is intent on making anyone who still isn’t onboard the long-USD monorail, shown originally here in this January 2015 post…

… get right on board.

From Goldman’s FX team explaining why “they hiked it and they liked it”

The Fed today raised interest rates for the first time since 2006, without – as our economists note – resorting to an overly dovish message. This was very much in line with our “hike it and like it” expectation and markets responded in the way we anticipated: the SPX bounced, EM currencies like the Mexican Peso strengthened, buoyed by the recovery in risk appetite, and the Dollar rose versus the G10. The turning point for price action came in the press conference, when Chair Yellen did not use a question on credit markets to head in a dovish direction, but emphasized the soundness of the financial system and strength of the economy instead (Exhibit 1).

As we argued prior to the meeting, risk markets tend to take direction from the Fed when uncertainty is elevated, as in September when a dovish FOMC caused risk to sell off, while risk rallied on the hawkish October statement. This pattern held true today, as Chair Yellen’s upbeat message helped markets put aside worries over credit markets.

Leave A Comment