For those who think the Fed is going to “save stocks” think again.

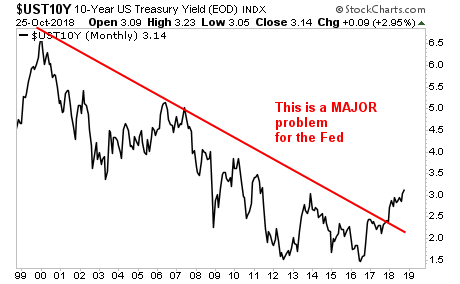

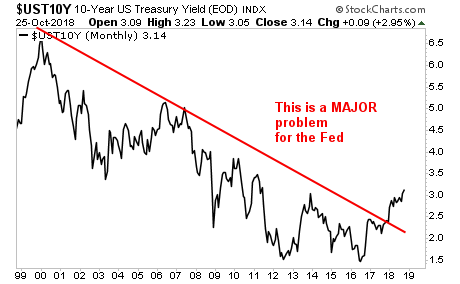

As I repeatedly have warned throughout 2018, the Fed is FAR more concerned about BONDS, than stocks.

When stocks collapse, investors lose money.

When bonds collapse, entire countries go broke.

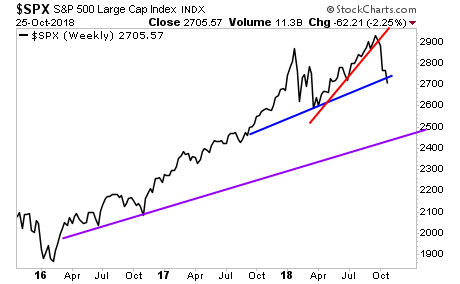

With that in mind, once the US bond market began to collapse, pushing yields above their long-term trendline, it became apparent that the Fed would “sacrifice stocks to save bonds.”

The reason? Letting stocks collapse will force capital into bonds, thereby forcing yields lower.

That process is now officially underway. And if you think the Fed is close to “stepping in” you’re mistaken. Cleveland Fed President Helen Mester just told CNBC this morning that “the stock market drop is FAR from hurting the US economy.”

This ties in with Fed Chair Jerome Powell’s assertion during a recent Q&A session that the Fed would not step in to prop up the stock market unless it was a sustained collapse that was bad enough to impact the REAL economy, specifically consumer spending.

In simple terms… the Fed’s not coming to the rescue this time. And stocks are going to have to drop a LOT further before it does.

Those who prepare to profit from this in advance stand to make literal FORTUNES. Over 99% of traders think the Fed is going to save the day.

It’s not.

Leave A Comment