Today the Federal Reserve raised the base US Fed Funds interest rate a quarter percentage point to the range between 0.75% and 1.00%. There was only one dissent from Minneapolis Fed President Neel Kashkari. And because this move was anticipated by everyone, the real question now goes to what comes next.

When we think of how the Fed will move going forward, we have to remember that the Fed has only two formal mandates— price stability and full employment. There is nothing about economic growth, exchange rate volatility, yield curve steepness or anything else that is directing Fed policy. The Fed does have an underlying role in preserving financial stability. But short of a crisis, that role is very much a secondary one two its dual mandate.

On price stability, the question is whether Fed officials believe they need to act pre-emptively to ward off inflation. In the past, that’s how the Fed has acted. And this pre-emptive tightening has invariably led to an inverted yield curve at some point in the business cycle, a sign of impending recession.

The fact that the Fed has raised rates twice before we have even hit the Fed’s 2% inflation mandate suggests that this pre-emptive thinking may still dominate Fed thinking. At the same time, Chair Yellen was at pains to stress during the Fed’s post-meeting press conference that she thinks the Fed Funds rate is still below a so-called neutral rate and that the Fed is, therefore, still adding policy accommodation. So the jury is still out on whether the Fed is tightening pre-emptively.

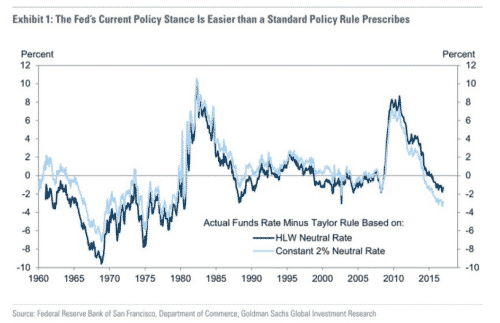

We do know, however, that some market participants now believe the Fed is behind the curve – something that will mean much more future tightening than anticipated. Here is a chart from Goldman Sachs’ Jan Hatzius comparing what the Fed Funds rate should be under a Taylor Rule approach and where it has been.

Notice that this shows the Fed being something like 2 or 3% too easy, meaning that — according to this rule —the Fed Funds rate should be something like 2.75 to 3.75% instead of 0.75%.

Leave A Comment