Three months ago, the Federal Reserve anticipated raising overnight lending rates four times in 2016. Now they are projecting just two hikes. At this rate, by the time June rolls around, Janet Yellen’s Fed will declare zero changes to interest rate policy for the entire calendar year. And in the fall? If there’s enough financial market turmoil, voting members of the central bank’s Open Market Committee (FOMC) may announce new quantitative easing measures in what will be dubbed by the media as “QE4.”

Lost in the euphoria over slashing rate hike estimates in half? The Fed cannot meaningfully distance itself from zero percent rate policy.

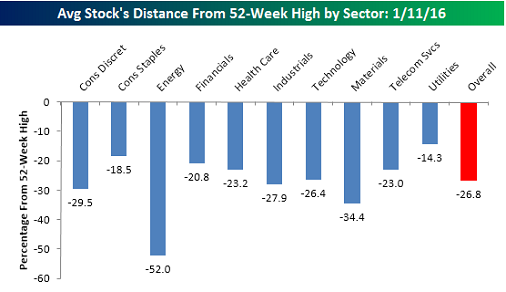

For one thing, the financial markets themselves go haywire at the mere prospect of “gradual stimulus removal.” Stocks plummeted in August of 2015, forcing the Fed to wait until December to make a singular quarter-point effort. And that negligible move in December? It brought about January’s collapse of faith that sent the average U.S. stock into bear market territory for the first time since the Great Recession.

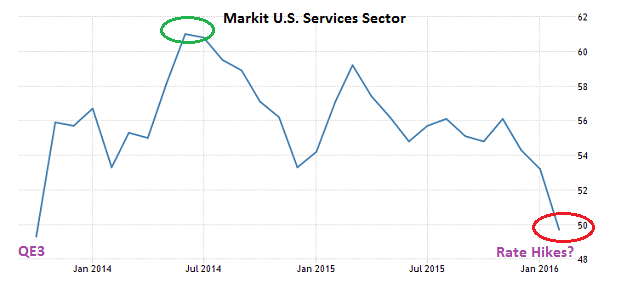

Secondly, the Fed may place the blame for the lackluster U.S. economy on global stagnation, but the results remain the same. The U.S. manufacturing segment fell into recession in 2015; the U.S. services sector recently hit a 28-month low, hitting a data point that is consistent with economic contraction.

The impressive stock rally off of the early February lows – an 11.5% monster bounce for the market-cap weighted S&P 500 – has many investors believing that the worst is in the rear view mirror. However, since the Fed began curtailing its bond buying/electronic money printing program (a.k.a. “QE3?) in earnest circa mid-2014, the U.S. economy has struggled. A peek out the front windshield suggests that the U.S. economy is likely to suffer if the Fed raises overnight borrowing costs any further.

Why on earth would modest quarter-point hikes have such a devastating impact on stocks? In a world where all of the central banks are loosening the reins, any tightening by the Fed is likely to strengthen the U.S. dollar. An unusually strong greenback adversely affects 50% of the strained earning potential of U.S. multi-national corporations. And that might lead to more earnings declines for already overvalued companies.

Leave A Comment