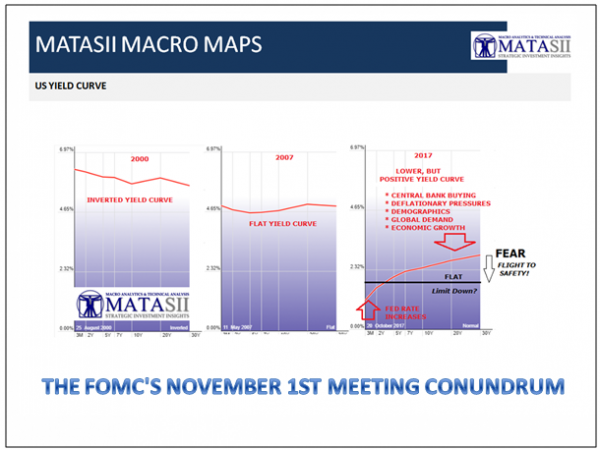

What Is The Conundrum?

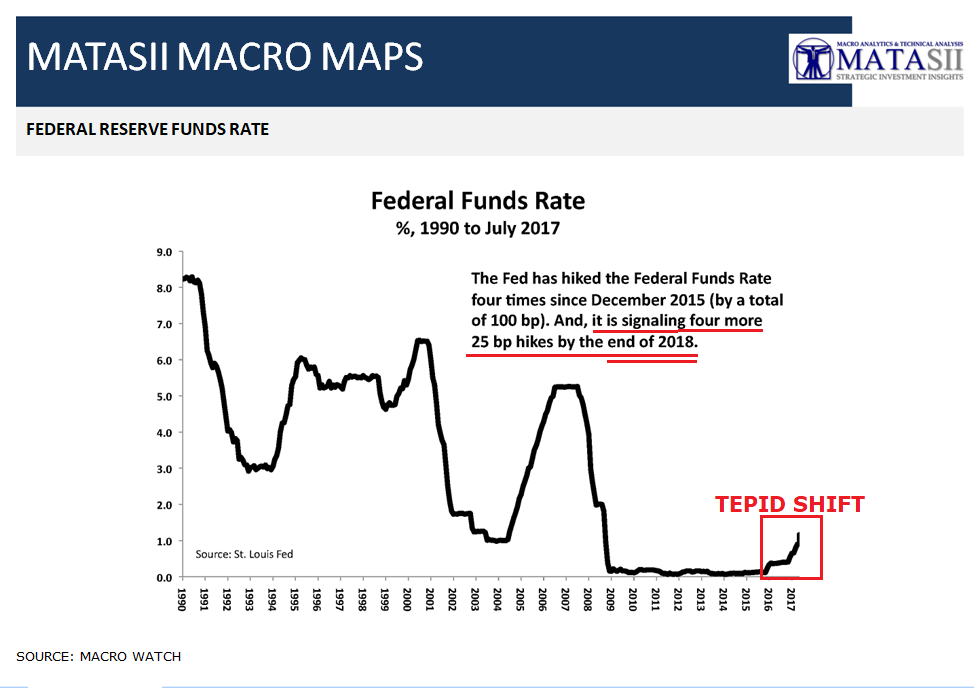

The Federal Reserve has been very clear through its’ forward policy guidance that it will slowly increase the Fed Funds Rate. “Slow” should more appropriately be described here as at a “Glacier Pace”!

Additionally, the Fed plans to gradually reduce the central banks’ balance sheet at a slowly increasing rate. A rate that over 15 months totals only 10% of the $4.5T growth in the Fed’s Balance Sheet since the beginning of the Fed’s Quantitative Easing (QE) and ZIRP.

The general perception is that going forward the Fed will either:

Why Quantitative Tightening?

The expressed reasons for the requirement for “Normalization” of US Monetary Policy is that the US Economy is now over 8 years into the recovery with low unemployment rates and signs of a broad-based (though weak) recovery. It is my opinion both of these conditions are not valid, however, I will leave that for another day.

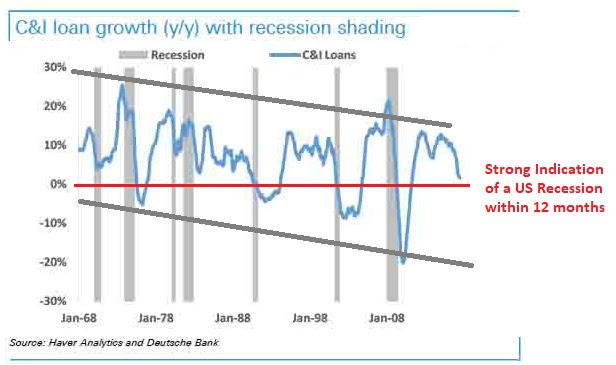

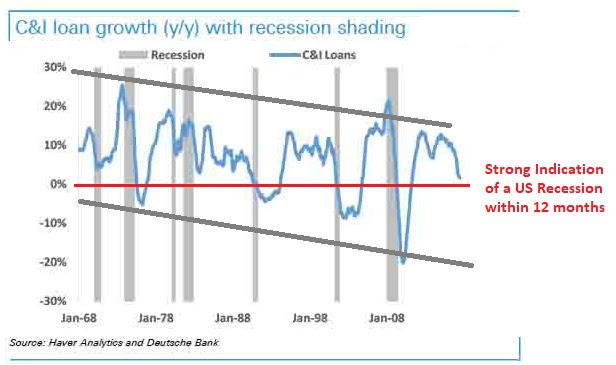

Instead, I would like to suggest what may be a few of the real reasons for the Fed’s QT stance is:

The above Fed Chart has been Extremely Accurate In Warning the Fed of Recessions (shown in grey)

What The Fed Sees

Having lived through and as an investor participated in 1987, 2000 and 2007 I learned a number of lessons. One is the importance of advanced shifts in the Currency, Credit and Yield markets prior to major reversals in the equity markets.

Leave A Comment