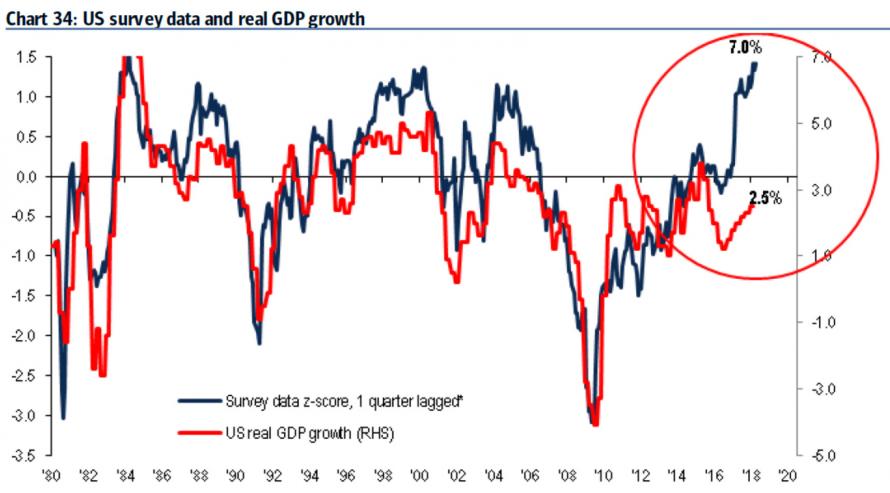

US economic growth expectations have slipped dramatically throughout Q1 as weaker-than-expected (real) macro data has spoiled the party (along with rising geopolitical risk). However, surveys of economic hope are hyped up on goldilocks-like hype – to an extent we have never seen before… ever.

As BofAML’s latest report shows, based on economic survey data, US economic growth should be (and should have been) up near 7%… a far cry from ‘reality’…

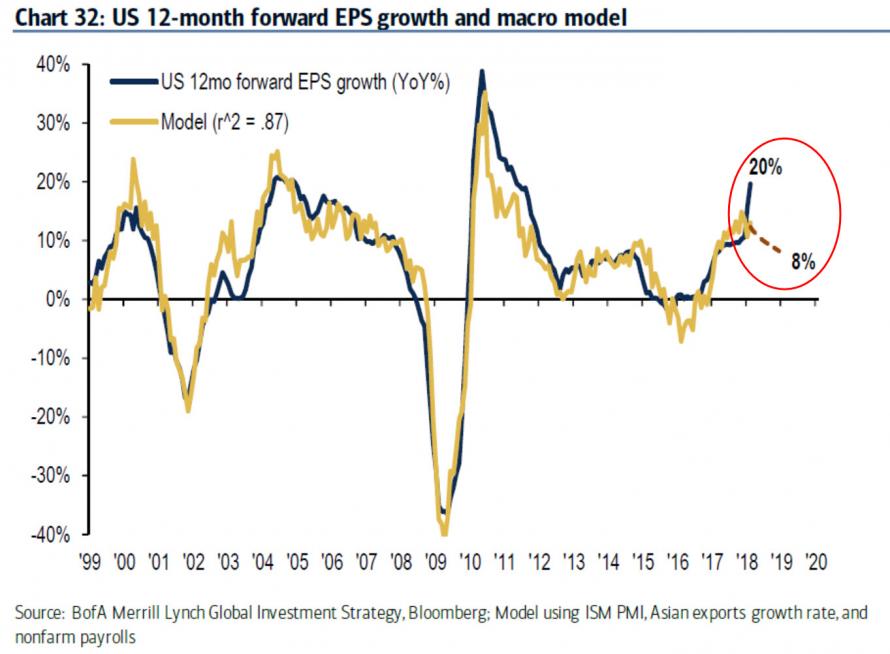

And perhaps even more worrisome is BofAML’s macro model divergence from the ‘micro’-economic surge in company’s earnings expectations (think tax cuts)…

In other words, profit bulls are now massively dependent on a sharp snapback in US GDP growth in Q2… just as the treade wars are hotting up.

Leave A Comment