Mario Draghi’s Hype Machine

The Gold Market is pretty interesting here, as investors realized on Thursday that much of what comes out of Mario Draghi`s mouth is complete hyperbole. Things aren`t nearly that dire in Europe, as some bankers try to persuade for additional stimulus out of the ECB. Germany isn`t going to sign off on the extreme bazooka stimulus measures because Germans are by nature, conservative and there is a commensurate symmetry between ratcheting up extreme monetary measures and stoking the fire of unintended consequences.

December Rate Hike Fully Priced into Markets

The Federal Reserve is all set to go on with a 25 basis point rate hike in two weeks, and the financial markets have priced this in to the tune of around 80%. The surprising tone of precious and industrial metals price action on Friday in the face of the US Dollar strengthening, and oil getting hammered on OPEC news was interesting to say the least. The entire complex rallied from Copper, Aluminum, Platinum, Palladium and Silver to Gold as new money moved into the sector, and stayed there even after Mario Draghi tried to walk the Euro back from Thursday`s currency gains vs. the US Dollar.

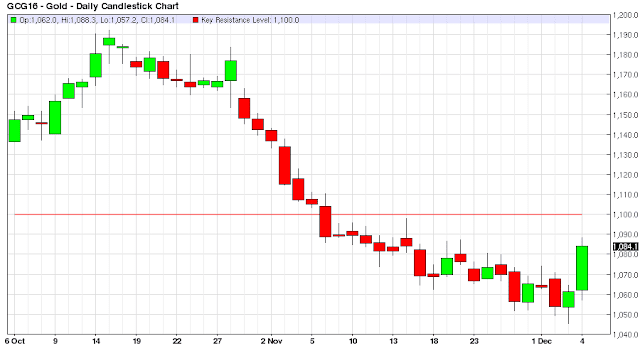

Gold Price Action

After putting in the low for the year on Thursday morning of $1,045 per troy ounce, Gold finished Friday at $1,084 on the February 2016 futures contract. Gold has been hovering right around the $1,060 – $1,070 level for the last two weeks, and even if this is just short covering, somebody forced those shorts to cover. Maybe financial markets and the Metals markets are starting to realize a ‘One and Done’ rate hike by the Federal Reserve isn`t the end of the world. And given the $18 Trillion (and climbing) in US Debt facing central bankers at the Fed they are going to have to be doing a whole lot of “monetizing” or, in layman`s terms, currency printing for the foreseeable future, and so Gold and other Metals look attractive here at multi-year lows.

Leave A Comment