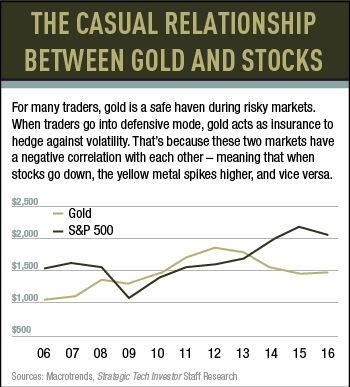

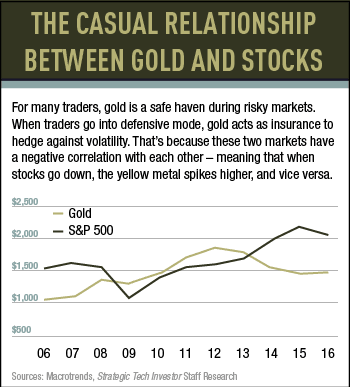

For instance, many investors dedicate a portion of their portfolio to gold or some other precious metal where it can act as a hedge against trouble in other markets.

Now, some of these folks go overboard, and you probably know a “gold bug” or two. But at bottom, this is a sound strategy, because precious metals generally aren’t affected by the ups and downs of the stock market.

Now, what you have in your hands isn’t a “gold report.” My main interest is in technology. And there is a way to make one particular piece of technology act like gold in your portfolio – by providing a measure of “insurance.”

Now, at first blush the idea that you can use some form of technology as portfolio insurance might sound odd.

But consider…

Right now big banks, credit card companies and other financial players are avidly exploring ways to use this “gold of tech”(and the science behind it) to disrupt the $500 billion payments industry.

What’s more, this technology is being adopted throughout the economy, in industries as diverse as real estate… art… law… stock trading…

As that upheaval in payments and in other sectors gathers steam, this “safety” play I’m about to show you could soar triple digits or more in the coming years.

So let’s investigate this “gold of tech.”

Up From the Underground

The “gold” I’m talking about is Bitcoin. The encrypted digital currency has been the talk of “underground” tech and privacy circles since 2009, when a writer with the pen name Satoshi Nakamoto released an “open source” paper describing it.

Satoshi’s idea was to create a decentralized currency outside of the control of government and the manipulation of the big banks.

I’ve followed Bitcoin developments since Day 1, both here at Money Morning and around the Web. I discuss it with hundreds of cryptocurrency investors and entrepreneurs on my social-media accounts.

And because of my deep background in monetary economics and cybersecurity, I like to think I have a better grasp on it than most.

Today I’m going to use that know-how to show you why Bitcoin’s rise has only just begun – and why it’s destined to become a true “unstoppable trend.”

I’ll also point to several ways you can invest in Bitcoin, whether as a long-term hedge… or as a way to capture some of the huge gains I’ve seen batted about.

Now, the “chatter” around Bitcoin has not always been positive. Far from it. Plenty of folks say this innovative investment has already run its course.

Even the writers at The Wall Street Journal (who should know better) recently ran a story with the foreboding headline “Is Bitcoin About to Break Up?”

What prompted that story was that one of Bitcoin’s key developers, Mike Hearn, resigned from the Bitcoin project. Hearn didn’t just walk away – he also penned an extremely negative essay calling the highly secure payments system a “failed” experiment. And he sold all his Bitcoins because, in his view, the network supporting the system was getting log-jammed.

I’ve lost count of how many Bitcoin “obituaries” I’ve read, but it’s in the hundreds. And all of them – including this latest one – miss a key point: Bitcoin is a global force so massive in its reach that no one person or event can stop it.

Leave A Comment