Dividends are the most common method that a company can use to return capital to shareholders. Dividend growth investors often place significant emphasis on dividend yields as a result.

However, share repurchases are also an important part of a healthy capital return program. Debt reduction should also be welcomed by investors.

There is a single financial metric that incorporates each of these factors (dividend payments, share repurchases, and debt reduction). It is called shareholder yield – and stocks with high shareholder yields can make fantastic long-term investments.

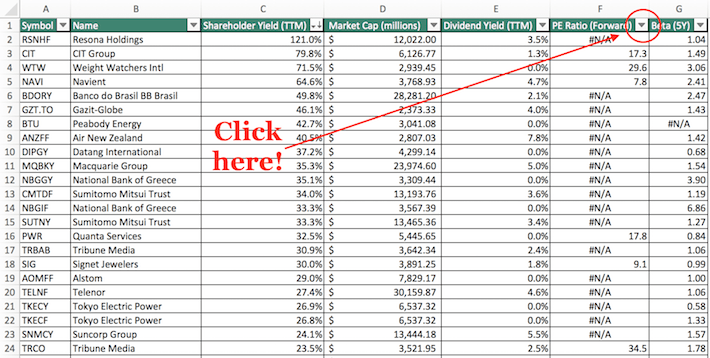

With that in mind, the High Shareholder Yield Stocks List that you can download below contains the 200 stocks with market capitalizations above $2 billion with the highest shareholder yields, showing the emphasis that these companies place on high capital returns.

Keep reading this article to learn more about the merits of investing in stocks with above-average shareholder yields.

How To Use The High Shareholder Yield List To Find Dividend Investment Ideas

Having an Excel document full of stocks that have high shareholder yields can be very useful.

However, the true power of such a document can only be unlocked when its user has a rudimentary knowledge of how to use Microsoft Excel.

With that in mind, this section will provide a tutorial of how to implement two additional screens (in addition to the screen for high shareholder yields) to the High Shareholder Yield Spreadsheet List.

The first screen that will be implemented is a screen for stocks that are trading at a forward price-to-earnings ratio less than 16.

Step 1: Download the High Shareholder Yield Spreadsheet List at the link above.

Step 2: Click on the filter icon at the top of the ‘PE Ratio (Forward)’ column, as shown below.

Step 3: Change the filter setting to ‘Less Than’ and input ’16’ into the field beside it.

Leave A Comment