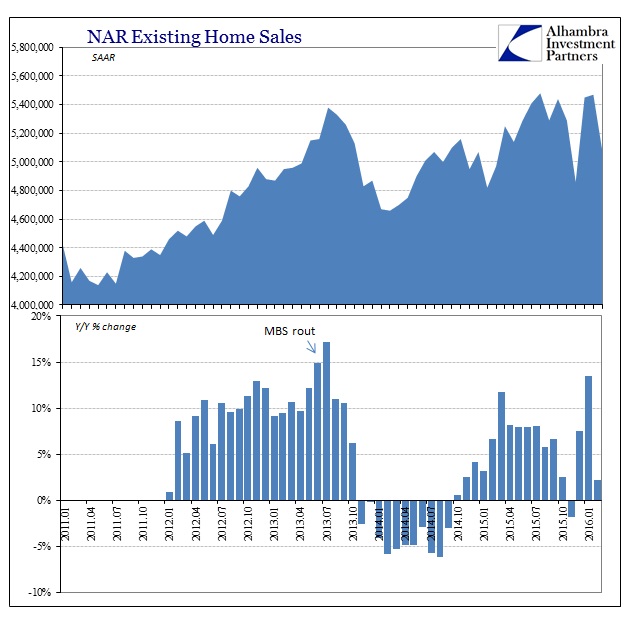

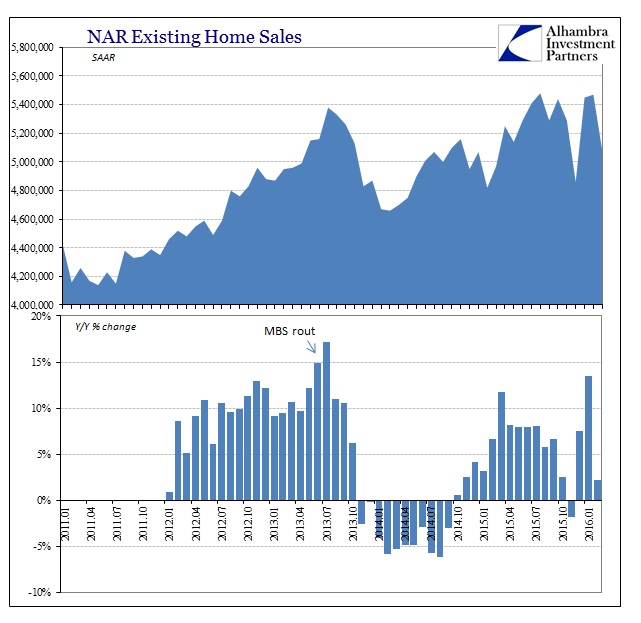

Existing home sales as reported by the National Association of Realtors fell 7.1% in February 2016 from the month before. It was a very large decline but followed a two-month surge beginning December 2015; which itself came after an unusually large decline in November. In other words, housing and home sales seems to be that much more volatile of late. That much is plainly obvious when comparing home sales since 2013 with the much tighter and more disciplined mini-bubble trend from before the “taper” selloff in the middle of 2013.

Reading through the NAR’s accompanying press release and really Chief Economist Larry’s Yun’s commentary, one is struck by how nothing seems to have changed. Here is Yun last year in March 2015 describing that February disappointment:

Severe below-freezing winter weather likely had an impact on sales as more moderate activity was observed in the Northeast and Midwest compared to other regions of the country…

With all indications pointing to a rate increase from the Federal Reserve this year – perhaps as early as this summer – affordability concerns could heighten as home prices and rents both continue to exceed wages.

Here is Yun today:

Sales took a considerable step back in most of the country last month, and especially in the Northeast and Midwest. The lull in contract signings in January from the large East Coast blizzard, along with the slump in the stock market, may have played a role in February’s lack of closings.

The overall demand for buying is still solid entering the busy spring season, but home prices and rents outpacing wages and anxiety about the health of the economy are holding back a segment of would-be buyers.

Weather is an ongoing theme for February sales, as if winter in the Northeast and the Midwest is winter. Here is Yun in April 2014:

With ongoing job creation and some weather delayed shopping activity, home sales should pick up, especially if inventory continues to improve and mortgage interest rates rise only modestly.

Leave A Comment