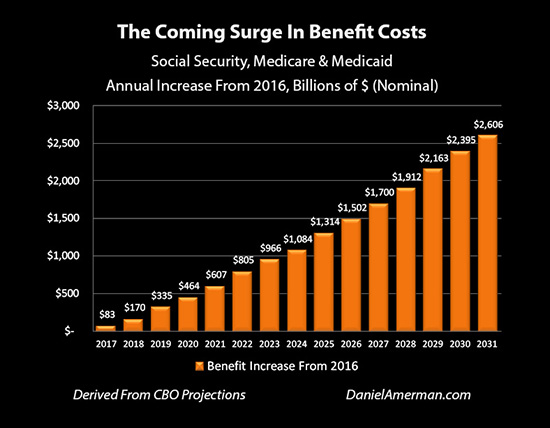

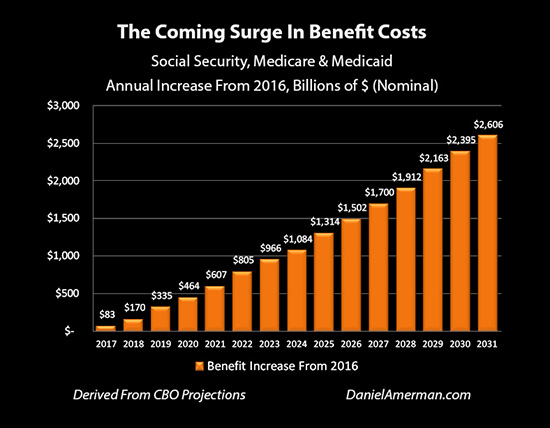

For decades we have known that the time would come when Social Security & Medicare costs would begin a rapid and explosive growth upwards. That time is no longer the distant future – but something that will take place next year, and the year after, and the year after. The long expected storm is now upon us, and as can be seen below, the amounts involved are staggering and they will arrive much faster than most people realize.

Based on Congressional Budget Office projections, total costs for Social Security, Medicare and Medicaid are likely to be about $120 billion greater in 2017 than 2016. Then almost double that amount in 2018, with an annual increase of $207 billion. Then almost double that amount again by 2019, with an increase of $372 billion compared to last year.

The half trillion dollar a year mark is likely to be hit by 2020 – before the next U.S. presidential election. With an annual increase in benefit spending that will continue to accelerate.

Benefit costs are anticipated to be a trillion dollars a year greater than their current cost by the year 2023. They’ll be one and half trillion dollars a year greater by 2026. And if current estimates are accurate, benefit costs will be $2 trillion greater than now – on an annual basis – by 2029.

The implication are profound for the national debt, retirement savings and benefit payments.

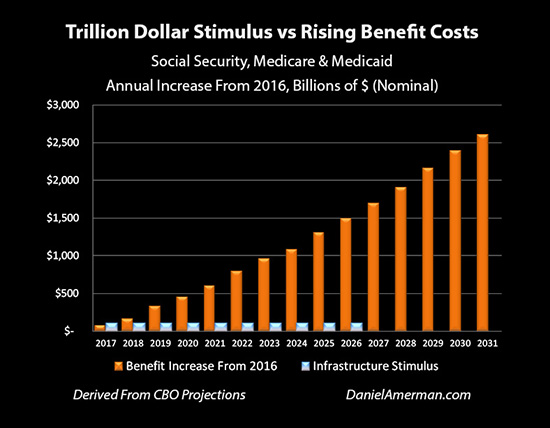

To add some perspective, let’s compare this to the massive, trillion dollar infrastructure stimulus program that is currently being proposed.

The proposed program is vast, with the idea being to rebuild roads, bridges and airports across the entire nation over ten years, pumping $100 billion a year into the economy in an attempt to stimulate growth. The stimulus program is so expensive that it may never get past Congress, at least not in whole.

Yet as demonstrated above, the increases in costs associated with the trillion dollar stimulus are effectively trivial in comparison to the increases in the scheduled costs of paying retirees their promised benefits.

Both Expected & Entirely New

What is coming with Social Security and Medicare (as well as Medicaid) is both expected – and entirely new.

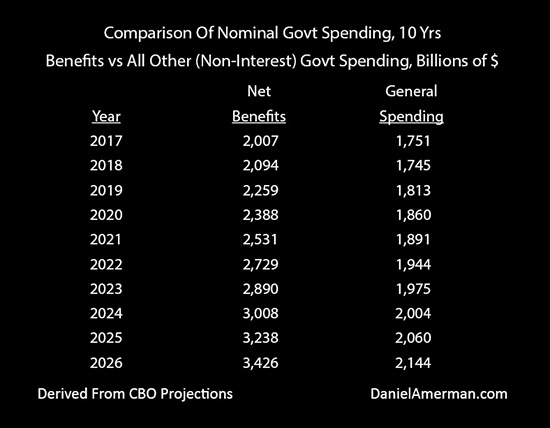

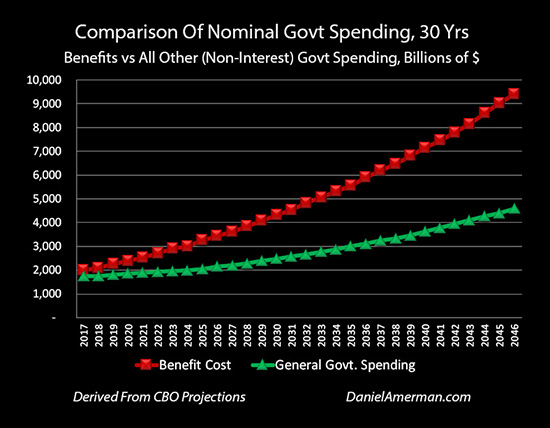

Historically, governments spent most of their money on general purposes – such as defense, infrastructure and running a large bureaucracy. That has gradually shifted over time, and by 2016, the annual costs of benefits had risen to almost $1.9 trillion, exceeding all other government spending combined (exclusive of interest payments on the national debt).

Moreover, based on Congressional Budget Office projections, benefits are expected to rapidly pull away from other governmental spending – exceeding $2 trillion for the first time in 2017, and $3 trillion by 2024.

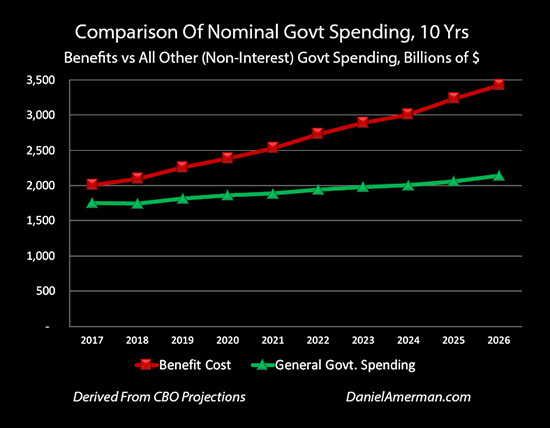

The speed with which benefit spending will come to dominate overall government spending to an unprecedented degree can be seen in the graph below.

As extreme as the changes will be in the 2020s when compared to what we have experienced in the past, they pale in comparison to what is scheduled to arrive in the 2030s and 2040s – with benefit spending alone reaching an annual rate of almost $10 trillion a year.

Adjusting For Inflation For A Clearer Picture

Even using the historically quite low rates of inflation projected by the CBO, much of the increases in benefit payments in the 2030s and 2040s are there because of a lower purchasing power of the dollar. When we adjust for inflation, the dollar amounts fall somewhat – but the costs are still extraordinary.

Leave A Comment