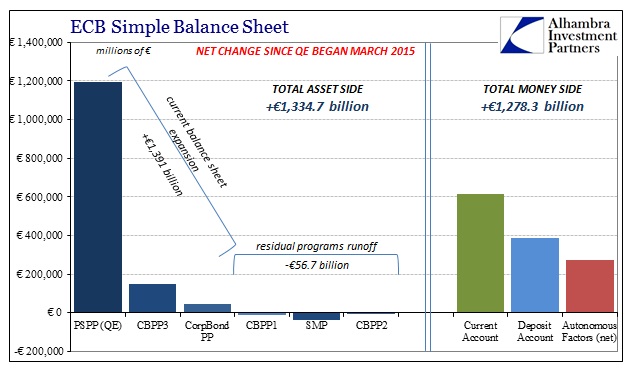

Since the ECB began the Public Sector Purchase Program (QE) in the middle of March 2015, it has purchased (through the end of November 2016) almost €1.2 trillion in securities from the financial sector. In addition to that, the central bank has bought €46.2 billion in corporate bonds, and €148 billion of covered bonds in a third iteration in that class. The whole transaction total is about €1.4 trillion of those three programs. We do have to consider the residual runoffs of prior balance sheet efforts, including the SMP and the prior two covered bond programs. Those are a net decline of €56.7 billion, bringing the total asset side to a net increase of around €1.33 trillion.

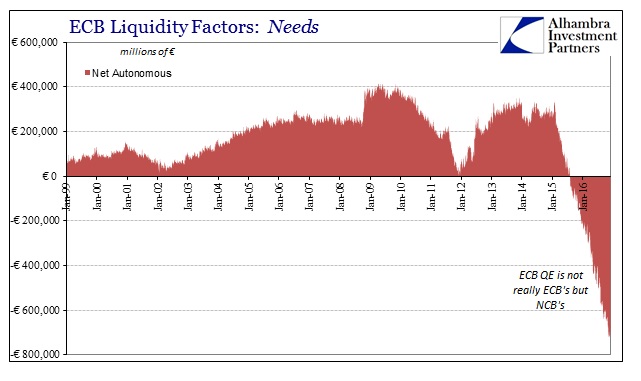

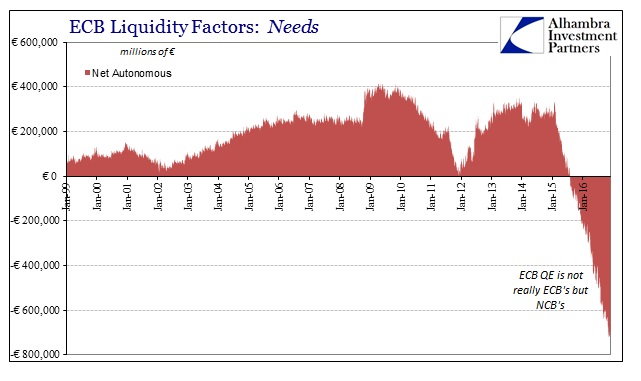

The other side of the ECB’s simple balance sheet is, essentially, the money side, or at least what is thought to be that. Over here is the deposit account and its NIRP, the current account of bank reserves, plus residual autonomous factors that include national government deposits of the various EuroSystem nations, as well as any contributions of the constituent National Central Banks. Since PSPP is conducted on the NCB level in order to shield the ECB from any potential repercussions of buying government bonds in those respective countries, we have to make an adjustment to figure out the net change for autonomous factors.

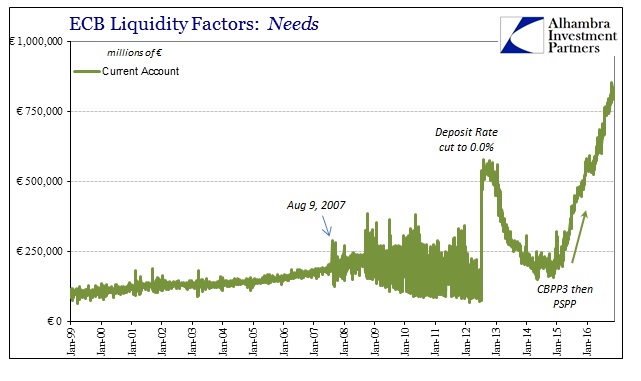

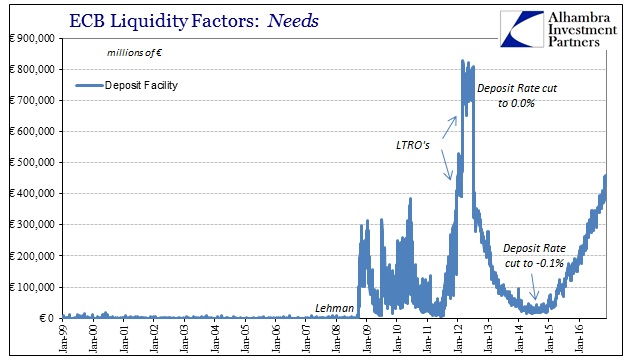

After doing so, on the “money” side of the simple balance sheet there has been an increase of +€614.9 billion in the current account, +€388 billion in the deposit account despite an increasingly negative interest rate on it, and then +€275 billion in autonomous factors beside the PSPP. In short, we know where all the “money” in Europe has gone – basically nowhere.

Instead, all this excess accounting has been languishing in what used to be money markets. The governing theory behind all these hundreds of billions (I won’t call them euros, because they are not) surmised that banks needed ample liquidity so as to be freed from fear of liquidity risk. That was the experiment of the LTRO’s crafted in late 2011; to flood the system with so much bank reserves that European banks would no longer pull back in lending and/or sell securities. It didn’t work.

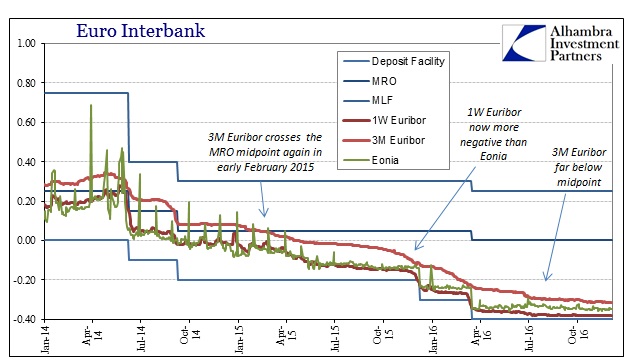

Having “learned” from that experience, the ECB then decided should it flood the system again with bank reserves, as it did starting in later 2014, this time it would penalize banks for not doing something with those reserves. They still refused. As you can plainly observe, “money” rates simply follow those increasing “money” penalties – to the point of epic distortions.

Prior to August 9, 2007, these unsecured money rates traded (mostly) at positive spreads to the repo-like Main Refi Rate (MRO) that used to count as the main monetary policy lever in Europe. Instead, even the 12-month Euribor, unsecured interbank lending at a term of 1-year, has fallen far below the rate of overnight ECB secured funding. Twelve-month Euribor is even now negative and getting more so by the week.

Leave A Comment