Policy-Induced Contrition in Japan

As we keep saying, there really is no point in trying to make people richer by making them poorer – which is what Shinzo Abe and Haruhiko Kuroda have been trying to do for the past several years. Not surprisingly, they have so to speak only succeeded in achieving the second part of the equation: they have certainly managed to impoverish their fellow Japanese citizens.

Shinzo Abe and Haruhiko Kuroda, professional yen assassins

Photo credit: Toru Hanai / Reuters

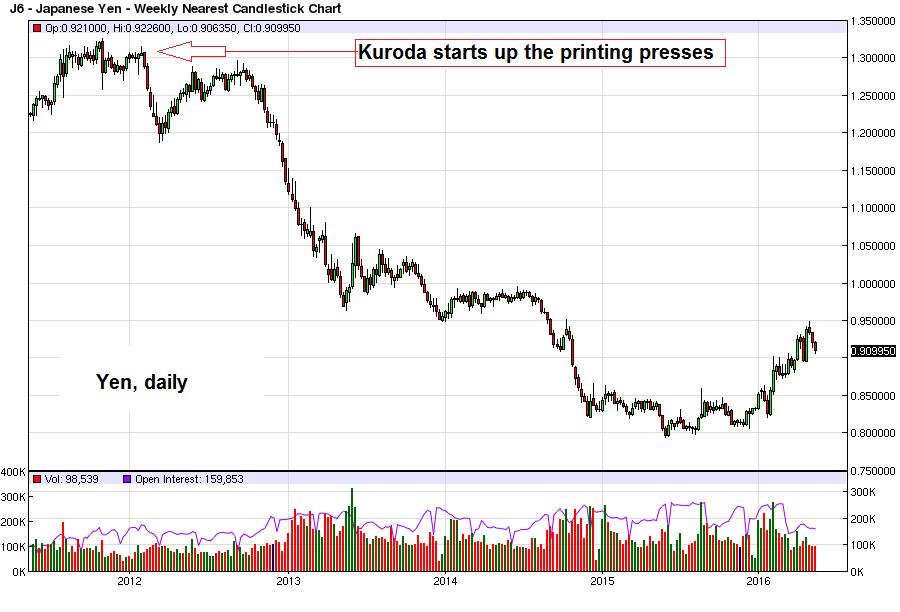

Just think about the relentless pressure on the yen in the years following Kuroda’s implementation of the “QQE” policy (colloquially known as “money printing”). Economic growth has gone precisely nowhere, which should be no surprise. No new wealth can be created by printing money. If that were possible, Zimbabwe would be a Utopia of riches.

What has happened though is that in US dollar terms, Japan’s economic output is worth about 30% less today than it was in 2012 when the Bank of Japan (BoJ) began to administer its version of bloodletting. In practical terms, Japan’s citizens have to produce 30% more in order to pay for the same amount of goods imported from abroad than they had to produce in 2012.

The declared goal of this policy is to “raise inflation”, i.e. to lower the purchasing power of the money the BoJ issues. There has been some “success”, as the real incomes of Japan’s citizens have plummeted since this policy has been instituted. Obviously, this is about as useful as a hole in the head. No-one really knows what this grotesque punishment of Japanese consumers is supposed to be good for.

The yen plummets due to the BoJ’s policies, impoverishing the Japanese. Not surprisingly, no positive effects whatsoever have been detected so far – click to enlarge.

Many companies have been affected by the BoJ’s inflationary policy as well, and now one of them has finally buckled under the onslaught. The price of Japan’s most popular soda-flavored ice cream bar Gari-Gari Kun, had to be be raised by 10 yen from 60 yen to 70 yen.

Leave A Comment