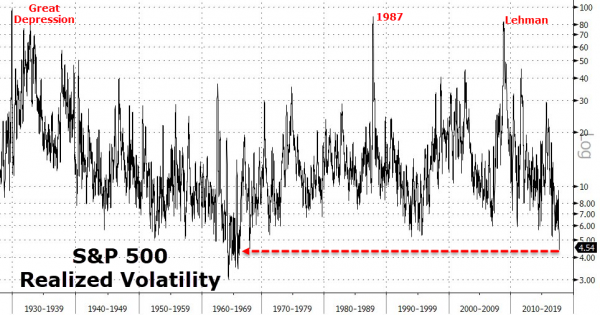

1966 was a big year... Miranda Rights came into being in America, Vietnam War protests raged, the US Department of Transportation was created, the mini skirt was invented, Batman and Star Trek debuts, NASA launches Lunar Orbiter 1 – the first U.S. spacecraft to orbit the Moon, race riots raged in Atlanta, Ronald Reagan entered politics becoming Governor of California, and (for some) most importantly, England defeated Germany to win the ‘Football’ World Cup.

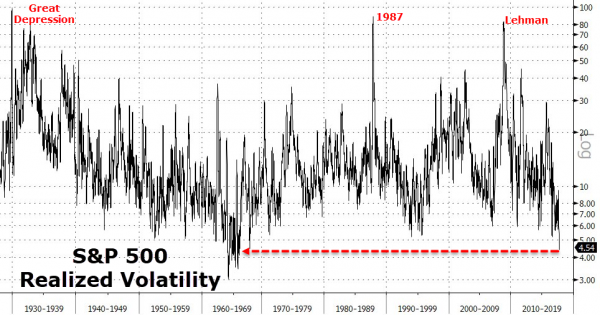

However, there is one more thing – 1966 was the last time that the stock market ‘calmness’ was as low as it is today…

To put that into context…

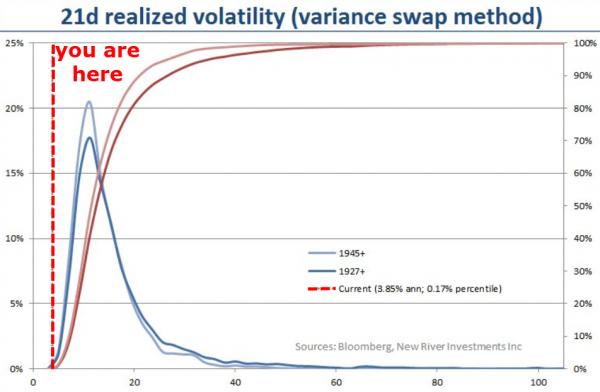

Furthermore, as New River Investments notes, “It’s difficult to overstate how low S&P500 realized volatility has been and how rare it is for it to be low for so long.”

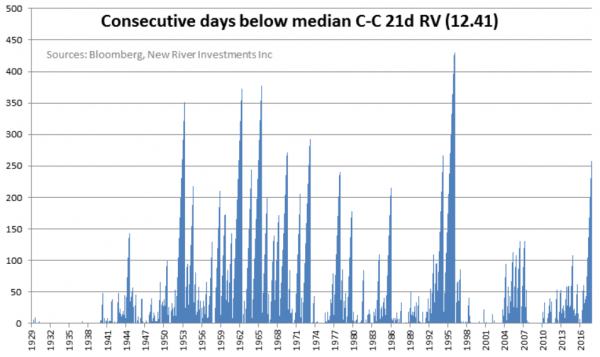

This is the longest period for realized vol to be below its historical media since the ’90s…

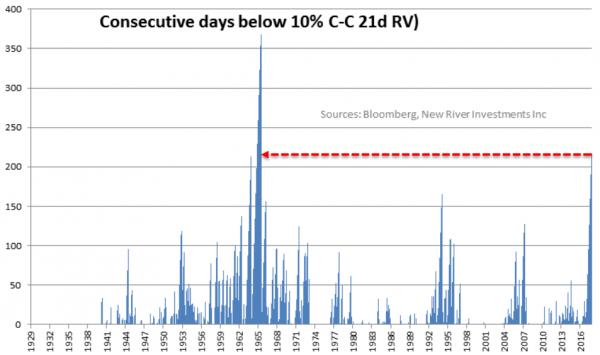

This is the longest period with volatility below 10% since the 1960s…

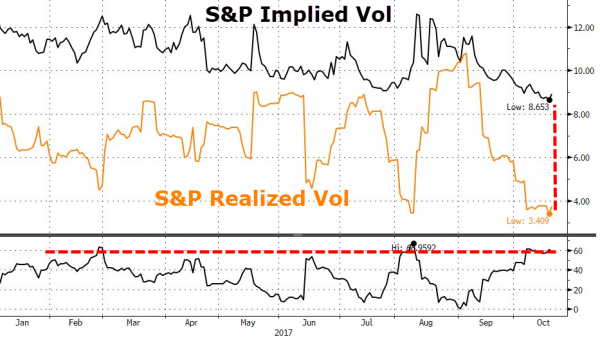

The reason we bring this up is simple – we have been noting the massive decoupling in the last month between stock price levels and implied risk levels…

This has been shrugged off by some with simpleton statements like “well, vol doesn’t go much lower than 10” – but of course that is all relative. With realized volatility collapsing to near record lows, the risk premium for future volatility is actually notably high…

In other words – that gaping chasm between prices and risk is ‘real’ – which perhaps explains why professionals have never been more relatively long ‘crash risk’…

Leave A Comment