The latest inflation data finally confirms what every consumer knows: Prices are going up. And now the Bureau of Labor Statistics agrees.

The Consumer Price Index (CPI) was up 0.5% in January. Economists had expected a 0.3% gain. Core inflation, which excludes food and energy, was up 0.3%, also a little more than expected.

Compared to a year ago, prices are up 2.1%. Core CPI is up 1.8%.

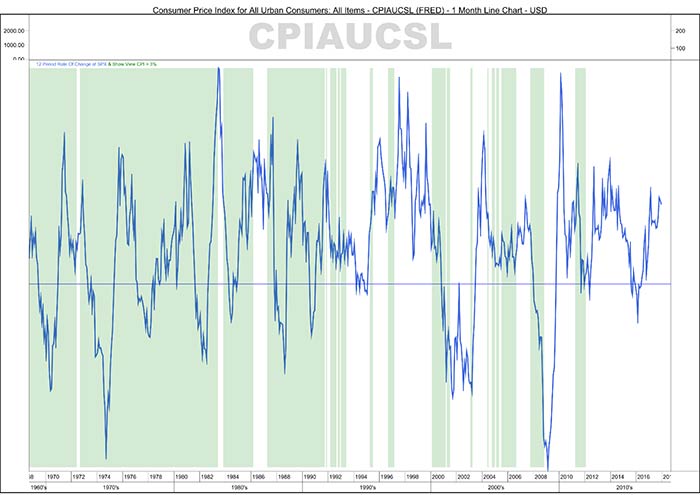

Initially, the stock market declined on the news. But the chart below is showing the latest inflation data isn’t anything to worry about.

The blue line is the yearly change in the S&P 500 Index. The green areas are times when the CPI was growing at more than 3% a year. The chart shows there is little relationship between the two.

Inflation may pick up, but stock prices are likely to ignore the change. In fact, stock prices are likely to rise.

With the inflation data above 3%, the S&P 500 Index traded with an average price-to-earnings (P/E) ratio of 19. For now, analysts expect earnings of about $157 in the index.

The S&P 500 should rise to about 2,983 to trade in line with the average P/E ratio. That’s more than 11% above the current price.

Smart investors should ignore the inflation news and the analysts explaining why inflation is bearish for stocks. They should buy in anticipation of higher prices.that will send cryptocurrencies soaring to record highs, the timing to take advantage of this strategy could not be any better.

Leave A Comment