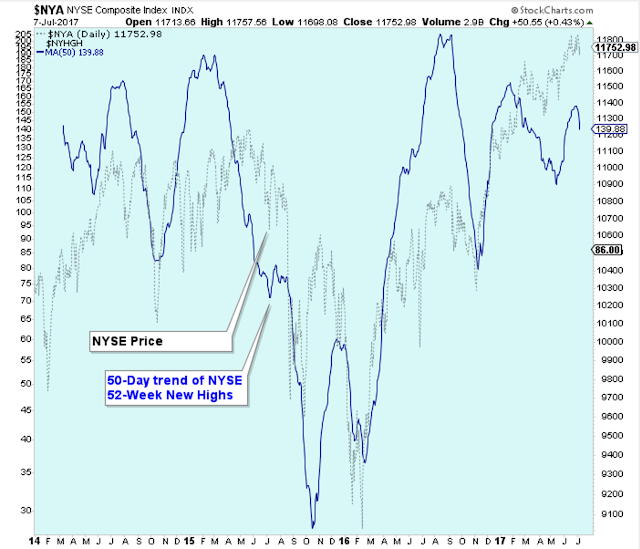

The 50-day average of new 52-week highs is pointed lower, so I would expect the broader market to struggle a bit until the 50-day starts to point higher again.

However, I wouldn’t get too concern about the longer-term health of the market unless this 50-day average trends decisively lower as it did in 2015.

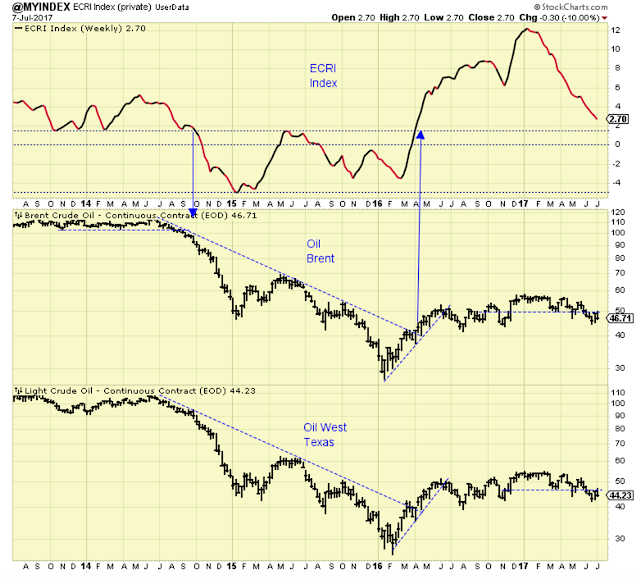

This chart shows the ECRI index has been declining all year long, and is now approaching an important level.

If the ECRI holds above 2% or so, then I think the economy provides just enough growth to support stock prices. But below 2%, and the economy (and oil prices) come under pressure to move lower.

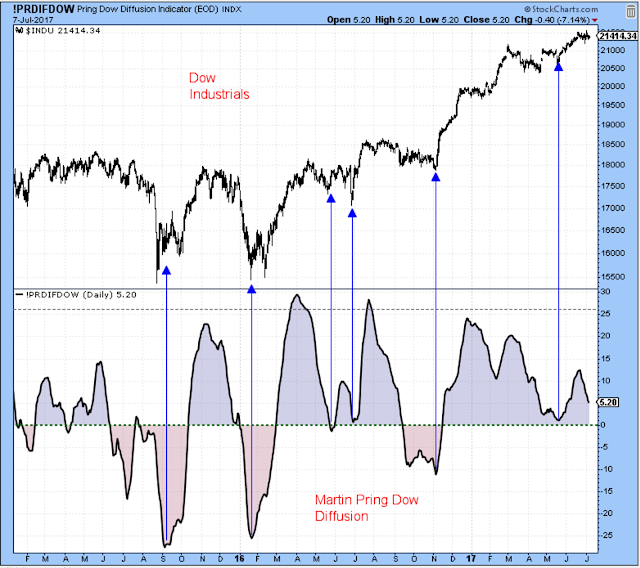

The Dow Diffusion is more a medium-term indicator, and it is pointing lower at the moment.

While the indicator moves lower but is above the zero level, I think stock prices are under pressure but hold up fairly well. But when the indicator dips under zero, then there is the potential for a more significant decline in prices.

This indicator has worked well for me, and I pay particular attention when it gets near zero. So, we have a week or two before getting too concerned.

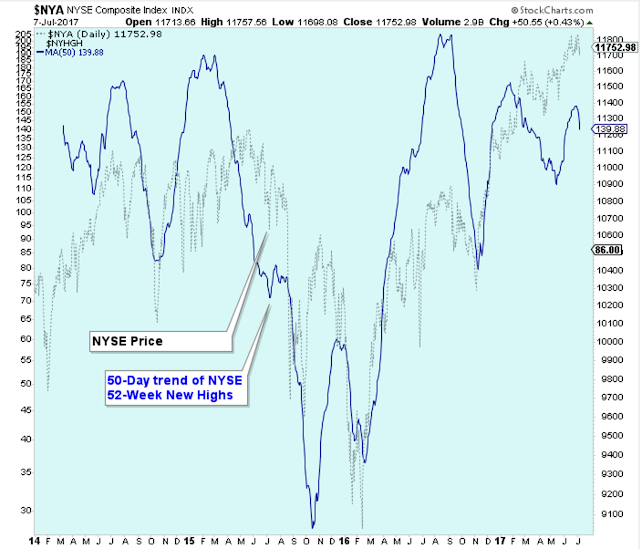

Here is a closer view of the same chart.

Outlook

The long-term outlook is positive.

The medium-term trend is down.

The short-term trend is down.

Leave A Comment