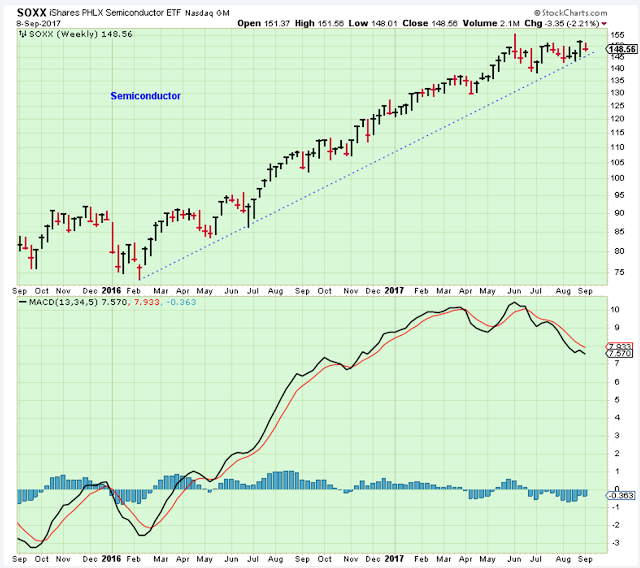

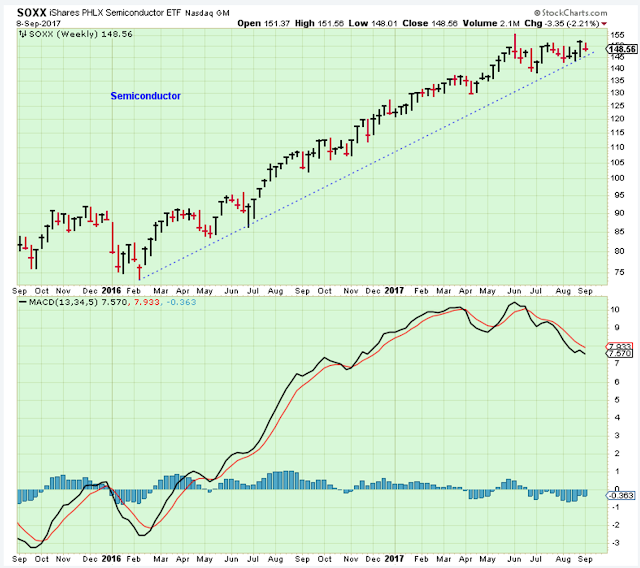

I really believe that the market will follow the semiconductor index either up or down. An optimist would look at this chart and see a very nice sideways, bullish consolidation pattern that started in June.

A pessimist, on the other hand, sees this as a bearish topping pattern confirmed by the momentum indicator pointing downward… and getting close to a dramatic break down below the trend.

I am watching this chart, ready to deploy my cash if it breaks out, but also ready to raise cash the minute it breaks down.

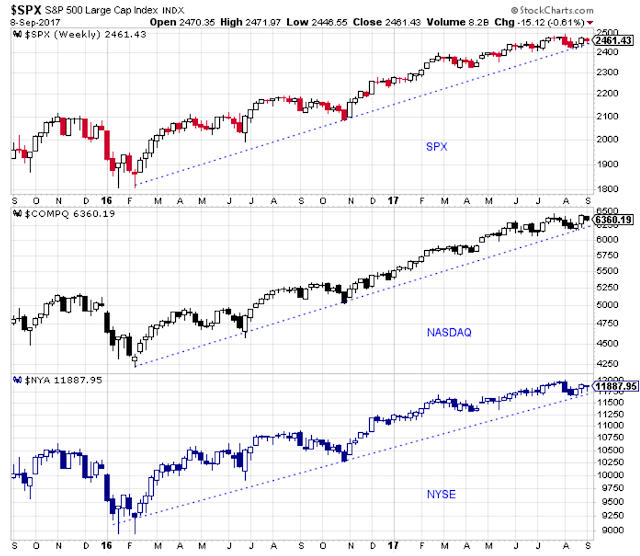

The major indexes are also near their uptrends. Watch these.

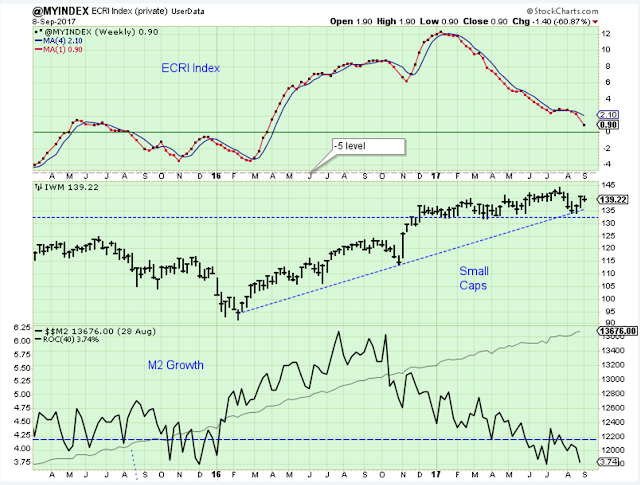

The ECRI has turned negative, and I downgraded the long-term outlook as a result. I don’t know exactly how to describe the current outlook, so I just called it “worrisome”. Maybe next week I will come up with a better word.

The ECRI index is clearly pointing to slower growth this fall and winter, and this works against stocks prices.

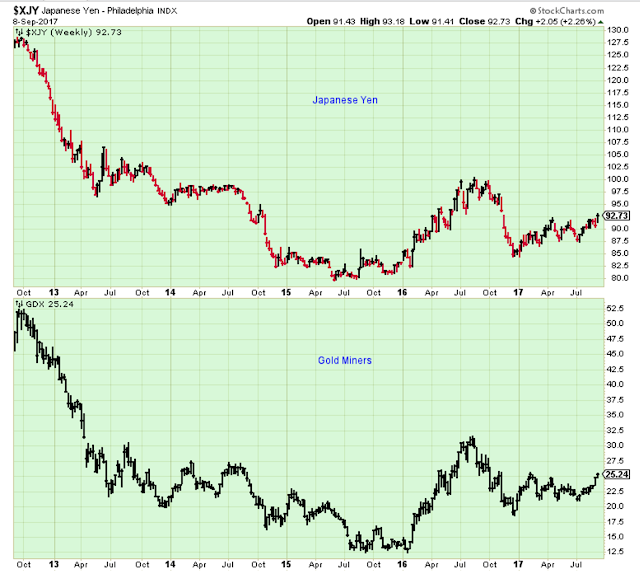

I have some new positions in the miners. Should I continue to hold? The Yen appears to be confirming the move in the miners, and is pointing higher. But, who really knows because the gold miners have been tough for me to trade this year.

Outlook

The long-term outlook is worrisome.

The medium-term trend is down.

The short-term trend is up. Watching for signs that the uptrend is topping.

Leave A Comment