As the head of financial and economic research at Buckingham Wealth Partners, I’ve been getting lots of questions about The Magnificent Seven—not the movie, one of the greatest westerns of all time starring Yul Brynner and Steve McQueen, but Apple (AAPL) (+35.2%), Amazon (AMZN) (+50.0%), Microsoft (MSFT) (+34.1%), Nvidia (NVDA) (+205.9%), Alphabet (GOOGL) (+53.3%), Tesla (TSLA) (+111.1%), and Meta Platforms (META) (+153.3%). FreepikThrough October 5, 2023, these stocks had returned an average of almost 92%. Together they account for basically the entire 12.4% gain of the S&P 500 Index—an equal-weighted version of the S&P 500 would have returned just 0.1%. What, if any, implications does such a dramatic dispersion in returns have for investors?While the performance of these stocks has been spectacular, it has led to the increased concentration of market-like portfolios, reducing the benefits of diversification and increasing a portfolio’s exposure to idiosyncratic risks. While market-cap-weighted indexes, by their nature, will have some concentration of risk in the largest stocks, thanks to the research team at Avantis, we can see that concentration levels for the 10 largest stocks in several common indices are now at historical highs. As Figure 1 below shows, while the concentration level for the S&P 500 Index was almost 31% at the end of August, it exceeded 51% for the Russell 1000 Large Growth Index. In contrast, the concentration level for the Russell 1000 Large Value Index was about 17% and about 15% for the MSCI EAFE Index. Concentration risk is dramatically lower in the small-cap indices: about 3% for the Russell 2000, about 6% for the Russell 2000 Growth, and less than 5% for the Russell 2000 Value.

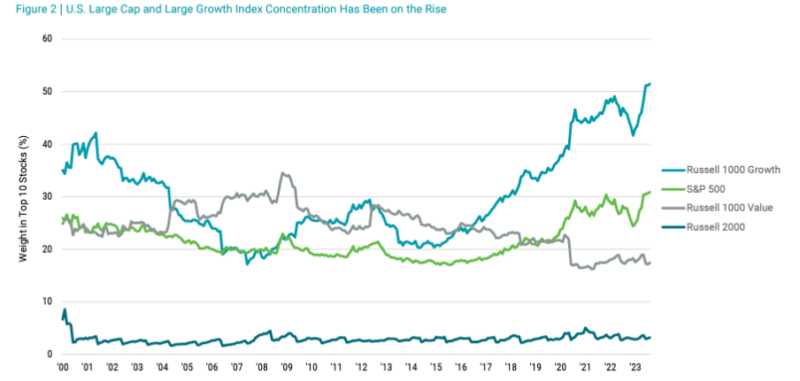

FreepikThrough October 5, 2023, these stocks had returned an average of almost 92%. Together they account for basically the entire 12.4% gain of the S&P 500 Index—an equal-weighted version of the S&P 500 would have returned just 0.1%. What, if any, implications does such a dramatic dispersion in returns have for investors?While the performance of these stocks has been spectacular, it has led to the increased concentration of market-like portfolios, reducing the benefits of diversification and increasing a portfolio’s exposure to idiosyncratic risks. While market-cap-weighted indexes, by their nature, will have some concentration of risk in the largest stocks, thanks to the research team at Avantis, we can see that concentration levels for the 10 largest stocks in several common indices are now at historical highs. As Figure 1 below shows, while the concentration level for the S&P 500 Index was almost 31% at the end of August, it exceeded 51% for the Russell 1000 Large Growth Index. In contrast, the concentration level for the Russell 1000 Large Value Index was about 17% and about 15% for the MSCI EAFE Index. Concentration risk is dramatically lower in the small-cap indices: about 3% for the Russell 2000, about 6% for the Russell 2000 Growth, and less than 5% for the Russell 2000 Value. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.The following chart shows that concentration levels have increased dramatically in recent years, while the levels for the smaller cap and value indices have been relatively stable. Note also that they are now significantly higher for the Russell 1000 Growth and S&P 500 Indices than before the dot-com bubble bursting in March of 2000. On the other hand, the concentration levels for the Russell 2000 and the Russell 1000 Value indices are at or near their lowest levels.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.The following chart shows that concentration levels have increased dramatically in recent years, while the levels for the smaller cap and value indices have been relatively stable. Note also that they are now significantly higher for the Russell 1000 Growth and S&P 500 Indices than before the dot-com bubble bursting in March of 2000. On the other hand, the concentration levels for the Russell 2000 and the Russell 1000 Value indices are at or near their lowest levels. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.The next table shows the historical concentration levels for various indices, including their minimum, maximum, and average concentration levels.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.The next table shows the historical concentration levels for various indices, including their minimum, maximum, and average concentration levels. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.What, if any, are the takeaways for investors? Investor TakeawaysThe data shown shouldn’t cause you to believe that the market is a bad investment simply because a subset of large companies constitutes a large portion of the overall market. However, when a small subset of companies makes up a large portion of a portfolio, for better or worse their returns will have a greater impact on overall portfolio results. Thus, the increased concentration of market cap and growth indices has led to increased portfolio risk. Investors should also be concerned that the increased concentration has been created by the dramatic rise in the valuations of the Magnificent Seven, which increased by far more than their earnings. The historical evidence clarifies that higher valuations typically lead to lower future returns.Consider that as of October 6, 2023, while the iShares Russell 1000 Growth ETF (IWF) had a P/E of 24.2 and Vanguard’s S&P 500 ETF (VOO) had a P/E of 20, the P/E of the Vanguard Russell 1000 Value ETF (VONV) was 15, the P/E of the Vanguard Russell 2000 ETF (VTWO) was 13.3, and the P/E of the Vanguard Russell 2000 Value ETF (VTWV) was just 10.5. Now consider the P/Es of the magnificent seven: Apple, 29.8; Amazon, 100.7; Microsoft, 33.8; Nvidia, 110.5; Alphabet, 29.4; Tesla, 73.8; and Meta Platforms, 36.8. That’s an average P/E of 59.3. History’s LessonsOne of my favorite expressions is that what you don’t know about investing is the investment history you don’t know. With that in mind, let’s review the list of the 10 largest stocks by market cap in the S&P 500 Index at the turn of the century. They were Microsoft, Cisco Systems, Exxon Mobil, Intel, Citigroup, IBM, General Electric, Oracle, and Home Depot. From January 2000 through September 2023, Vanguard’s 500 Index Fund (VFINX) returned 6.5% per annum. How did the top 10 perform?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.What, if any, are the takeaways for investors? Investor TakeawaysThe data shown shouldn’t cause you to believe that the market is a bad investment simply because a subset of large companies constitutes a large portion of the overall market. However, when a small subset of companies makes up a large portion of a portfolio, for better or worse their returns will have a greater impact on overall portfolio results. Thus, the increased concentration of market cap and growth indices has led to increased portfolio risk. Investors should also be concerned that the increased concentration has been created by the dramatic rise in the valuations of the Magnificent Seven, which increased by far more than their earnings. The historical evidence clarifies that higher valuations typically lead to lower future returns.Consider that as of October 6, 2023, while the iShares Russell 1000 Growth ETF (IWF) had a P/E of 24.2 and Vanguard’s S&P 500 ETF (VOO) had a P/E of 20, the P/E of the Vanguard Russell 1000 Value ETF (VONV) was 15, the P/E of the Vanguard Russell 2000 ETF (VTWO) was 13.3, and the P/E of the Vanguard Russell 2000 Value ETF (VTWV) was just 10.5. Now consider the P/Es of the magnificent seven: Apple, 29.8; Amazon, 100.7; Microsoft, 33.8; Nvidia, 110.5; Alphabet, 29.4; Tesla, 73.8; and Meta Platforms, 36.8. That’s an average P/E of 59.3. History’s LessonsOne of my favorite expressions is that what you don’t know about investing is the investment history you don’t know. With that in mind, let’s review the list of the 10 largest stocks by market cap in the S&P 500 Index at the turn of the century. They were Microsoft, Cisco Systems, Exxon Mobil, Intel, Citigroup, IBM, General Electric, Oracle, and Home Depot. From January 2000 through September 2023, Vanguard’s 500 Index Fund (VFINX) returned 6.5% per annum. How did the top 10 perform?

The average return to the 10 largest stocks in the S&P 500 Index from January 2000 through September 2023 was just 3.2%, underperforming the index itself by 3.3 percentage points. Because these were the largest stocks, the underperformance relative to the remaining 490 stocks was even worse. Investors in the top 10 stocks took a much greater degree of idiosyncratic risk and earned lower returns. Forewarned is forearmed. Done properly, diversification of risk is an investor’s friend, reducing the volatility of a portfolio without reducing its risk-adjusted expected returns. On the other hand, concentrated portfolios increase the potential dispersion of outcomes without increasing expected returns. Thus, all else equal, less-concentrated portfolios should be preferred. One way for investors to diversify the risk of concentration, as well as high valuations, is to move their allocations more toward value strategies, which over the long term have produced above-market returns.More By This Author:Is Inflation Ever Going To Go Down?

The Performance of Major Private Equity/LBO Firms

Dissecting The Idiosyncratic Volatility Puzzle

Leave A Comment