My Swing Trading Approach

I remain loaded up on long positions, and will make my first priority to be raising my stop-losses, to make sure I am protecting gains. Adding new positions will be considered secondary.

Indicators

VIX – VIX dropped 10% and flirting with a rare sub-9 move. There tends to be a lot of “pops” though at these levels.

T2108 (% of stocks trading below their 40-day moving average): One of its biggest moves of late – 16.3%, taking it back to 59%. Needs another similar move today to remove the concerns seen with the bearish divergences of late.

Moving averages (SPX): Trading back above the 5-day moving average and all other moving averages.

Industries to Watch Today

Healthcare and Technology led the way on Friday, with the latter finally looking like it wants to break out of its funk. Financials, Defensive, Cyclical and Industrials all sitting at their highs and ready for a bigger move higher.

My Market Sentiment

Market rally on Friday, despite the end of day sell-off, keeps a strong bullish bias for this market. Coupled with today’s gap up, there is very little reason to be short this market at this time.

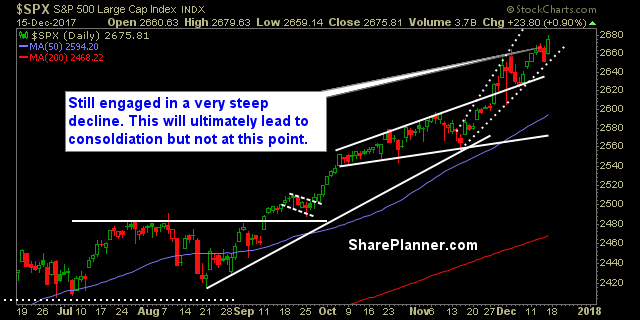

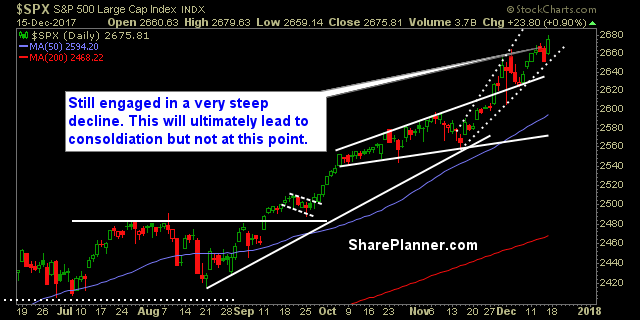

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment