A short-term uptrend is struggling to emerge. The sellers seem done for now, but there just aren’t enough buyers willing to step in yet.

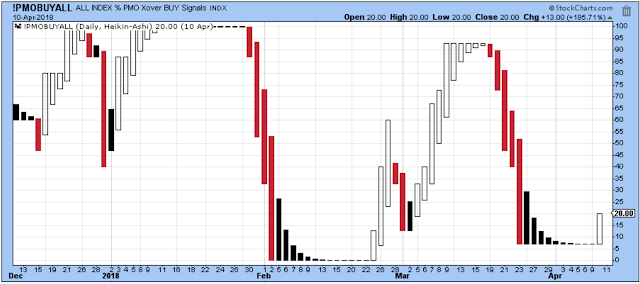

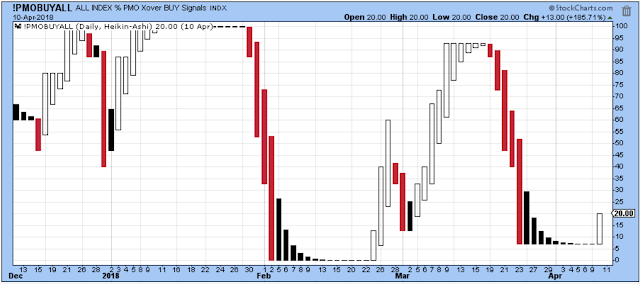

Yesterday, the PMO Index turned up nicely, and the number of new 52-week lows was at a harmless level. Both are bullish signals.

But there are so few new 52-week highs, and the market needs the new highs to help pull up the rest of the stocks.

We just have to be patient and wait for this current consolidation to complete.

Side Notes:

VIX Squared has just reported on Twitter that bullish sentiment is now down to a level that favors stock prices from a contrarian point-of-view.

Investors.com pointed readers to a CBO report that estimates the Federal deficit to be at least 2 Trillion dollars by 2028. Insanity!

Outlook Summary:

The market is having a tantrum as the tariff tit-for-tat appears to be getting serious. The crazies and the unqualified are running the White House, and investigators are circling closer and closer.

However, the mood swing away from stocks was inevitable after such a terrific run higher for stocks starting with the 2016 election.

I don’t think the bull market is over yet, but it is getting old and we have been very fortunate over the last ten years. Time to start appreciating what we have, and protecting it as best we can.

The long-term outlook is increasingly cautious. Reduce overall exposure to stocks on rallies.

The medium-term trend is down.

The short-term trend is down.

The medium-term trend for bonds is up.

Leave A Comment